[매크로] BlackRock 블랙록이 바라보는 2023년 투자시장

- 블랙록에서 2023년 투자시장 전망에 관한 리포트를 발간하였습니다. 이번 포스팅에서는 블랙록이 눈여겨보고 있는 핵심 주제들에 대해 소개해 보도록 하겠습니다.

<Source: BlackRock Investment Institute>

목차

- 2023 Playbook

- Tactical Views

- Strategic views

- New regime

- Theme 1 - Pricing the damage

- Theme 2 - Rethinking Bonds

- Theme 3 - Living with Inflation

- Regime drivers

- Aging workforces

- A new world order

- Faster transition

- Private Markets - The long view on infrastructure

- Directional view - Getting granular

1. 2023 Playbook

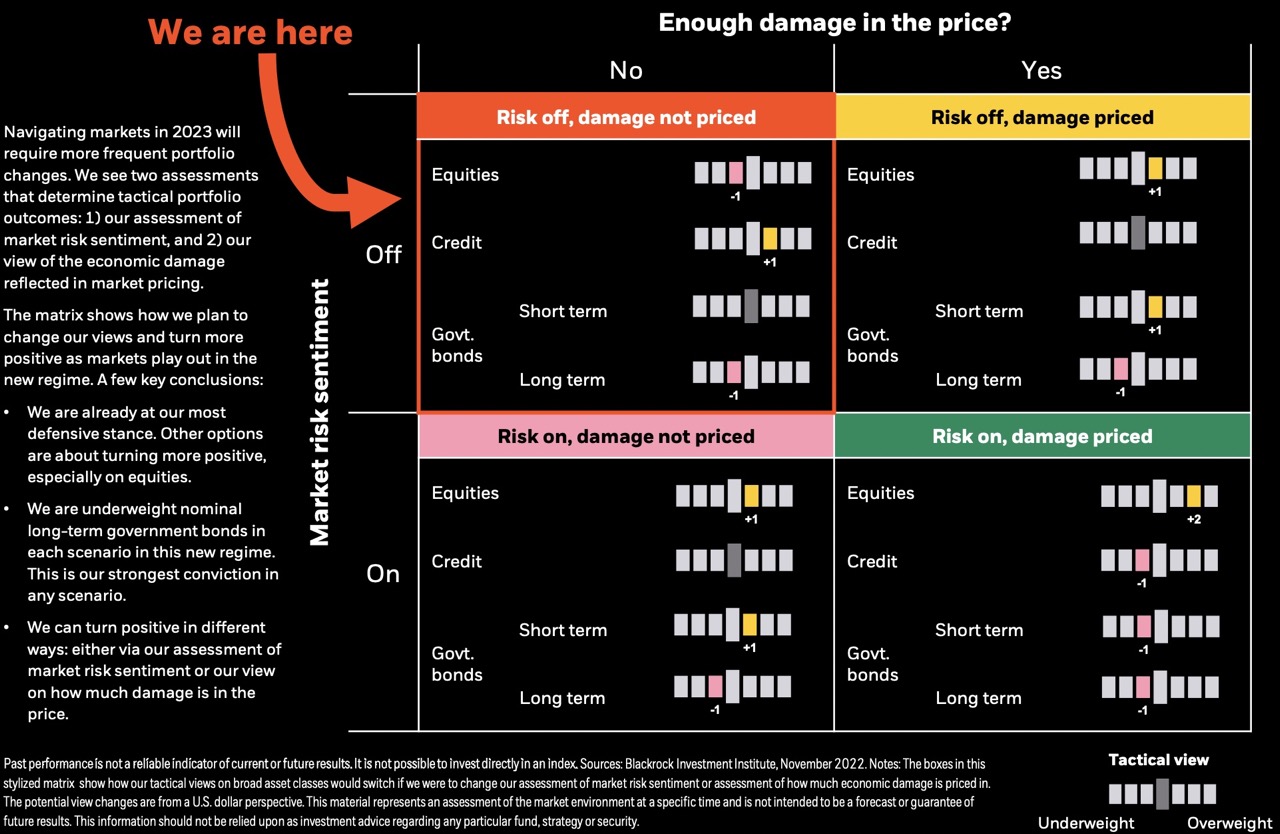

a) Tactical views - A new playbook

- 2023 = RISK-OFF with a preference for income over equities and long-term bonds.

- Expecting more volatile views than the past

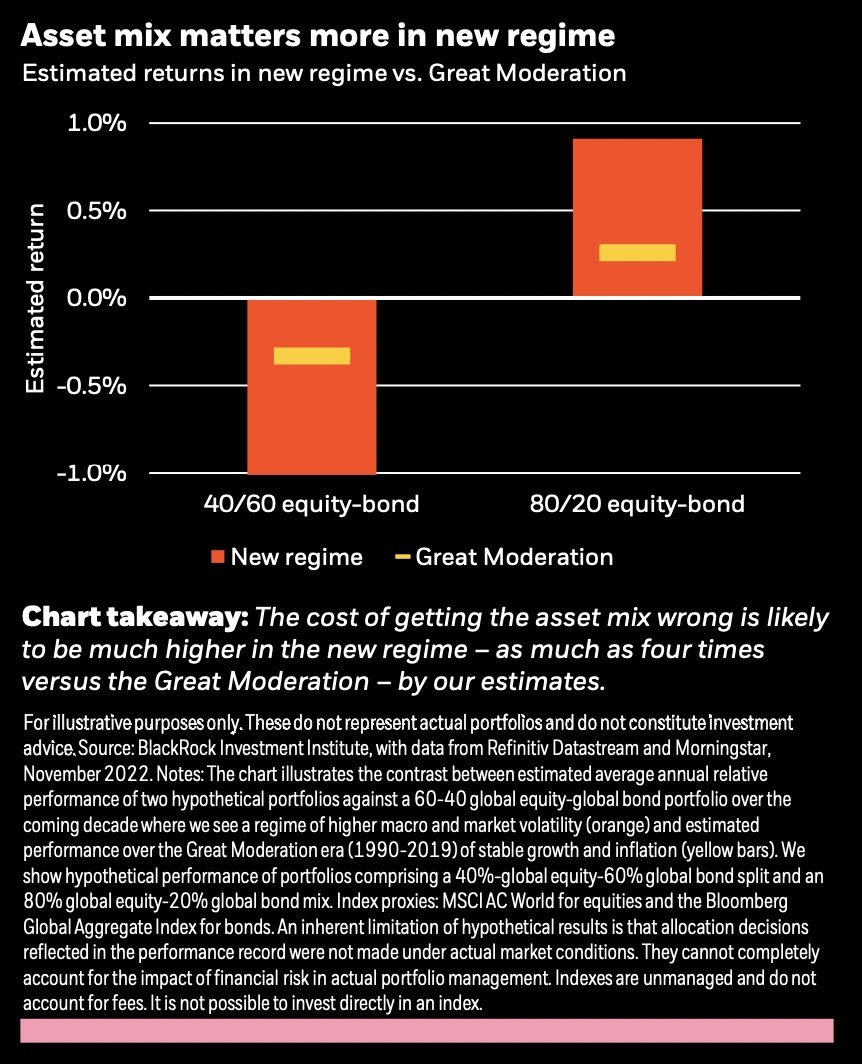

b) Strategic views - A new strategic approach

- Portfolios need to be more dynamic.

- Inappropriate asset mix can be even more costly.

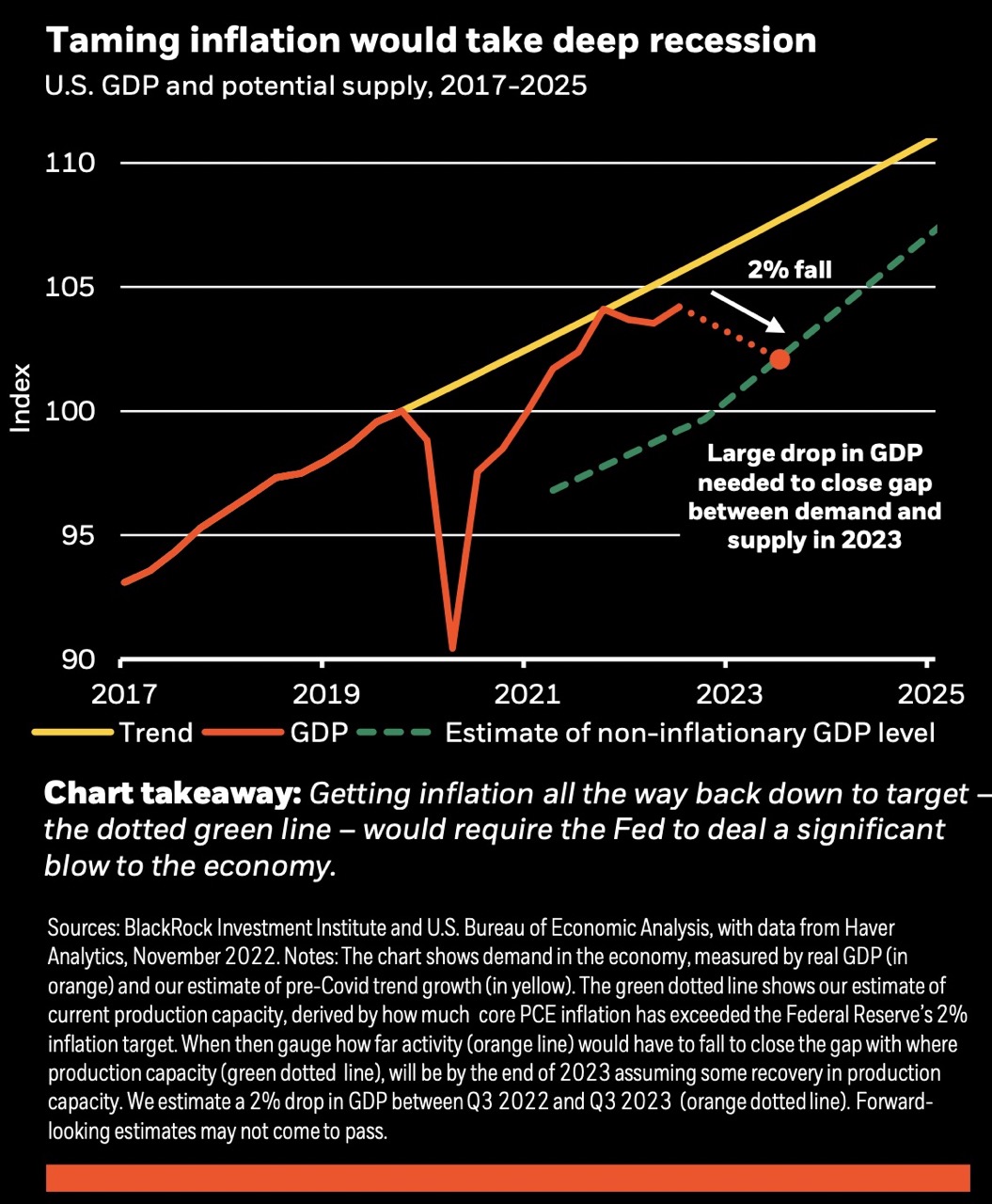

2. New regime

- A deep recession is inevitable in order to tame inflation since central banks cannot solve production constraints, which are fueling inflation and macro volatility.

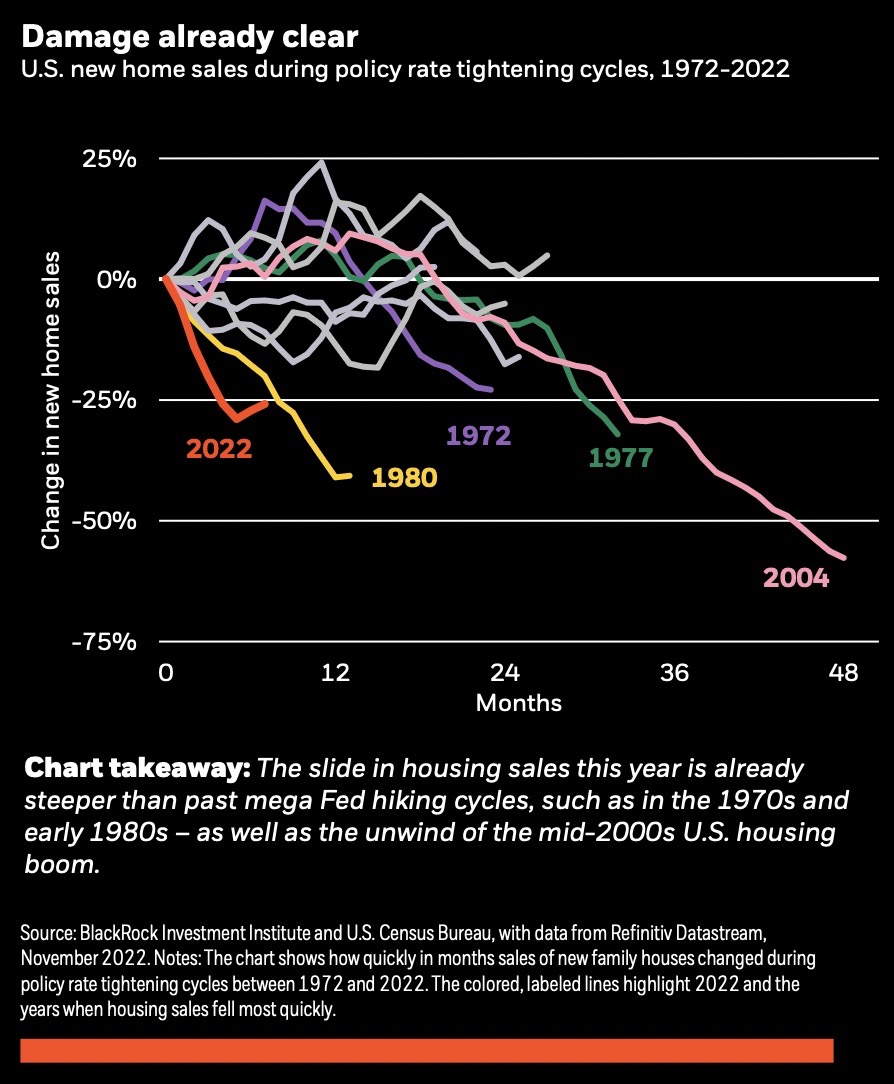

a) Theme 1 - Pricing the damage

- Equties are not fully priced in for recession.

- Assessment of the market's risk sentiment or how much economic damage is in the price should follow by.

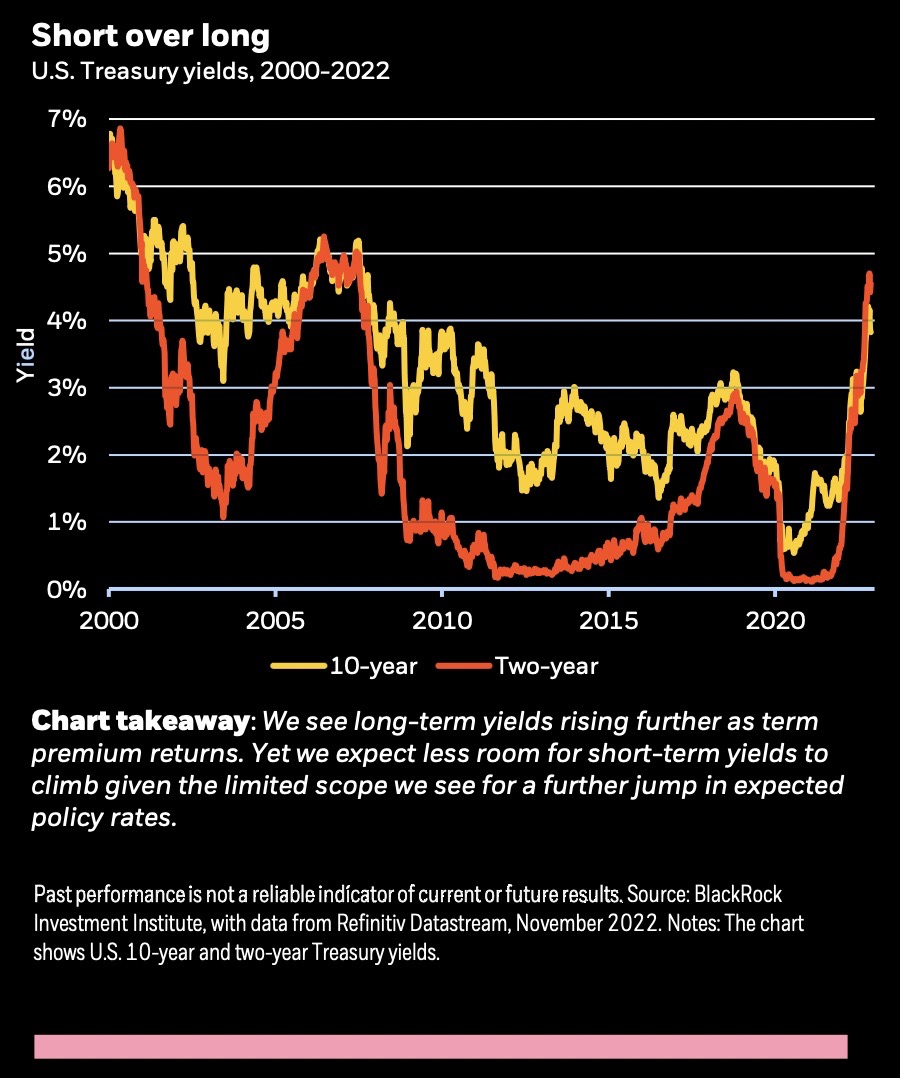

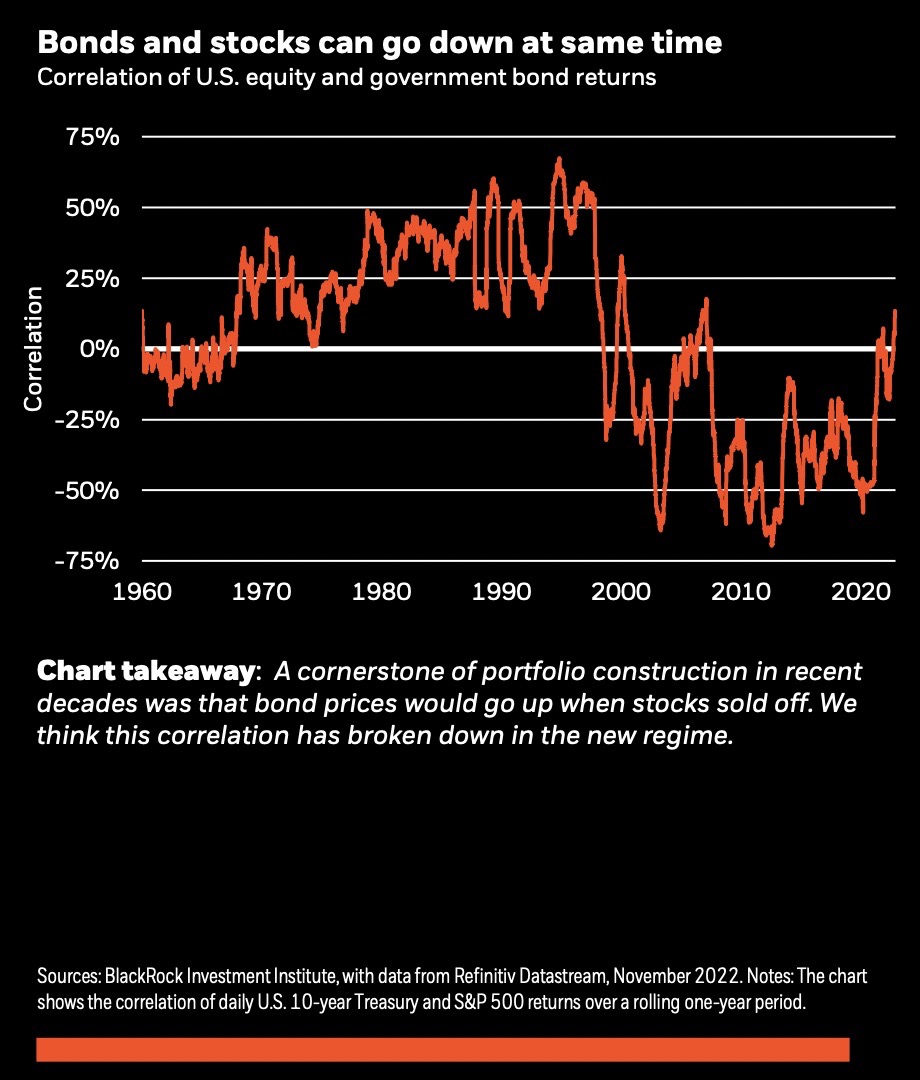

b) Theme 2 - Rethinking Bonds

- Negative correlation of stock & bond has broken down in new regime.

- Prefer short-term bonds and high-grade credit.

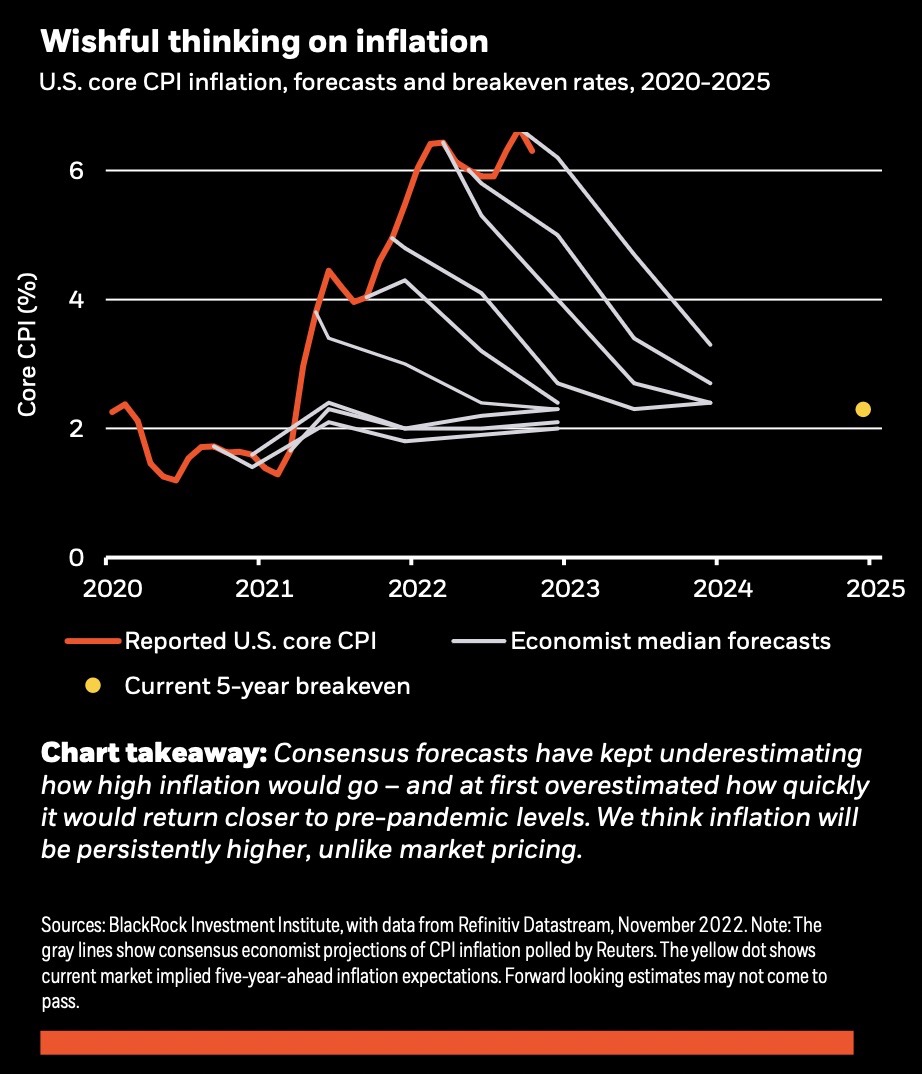

c) Theme 3 - Living with Inflation

- Long-term drivers of the new regime will keep inflation persistently higher.

3. Regime drivers

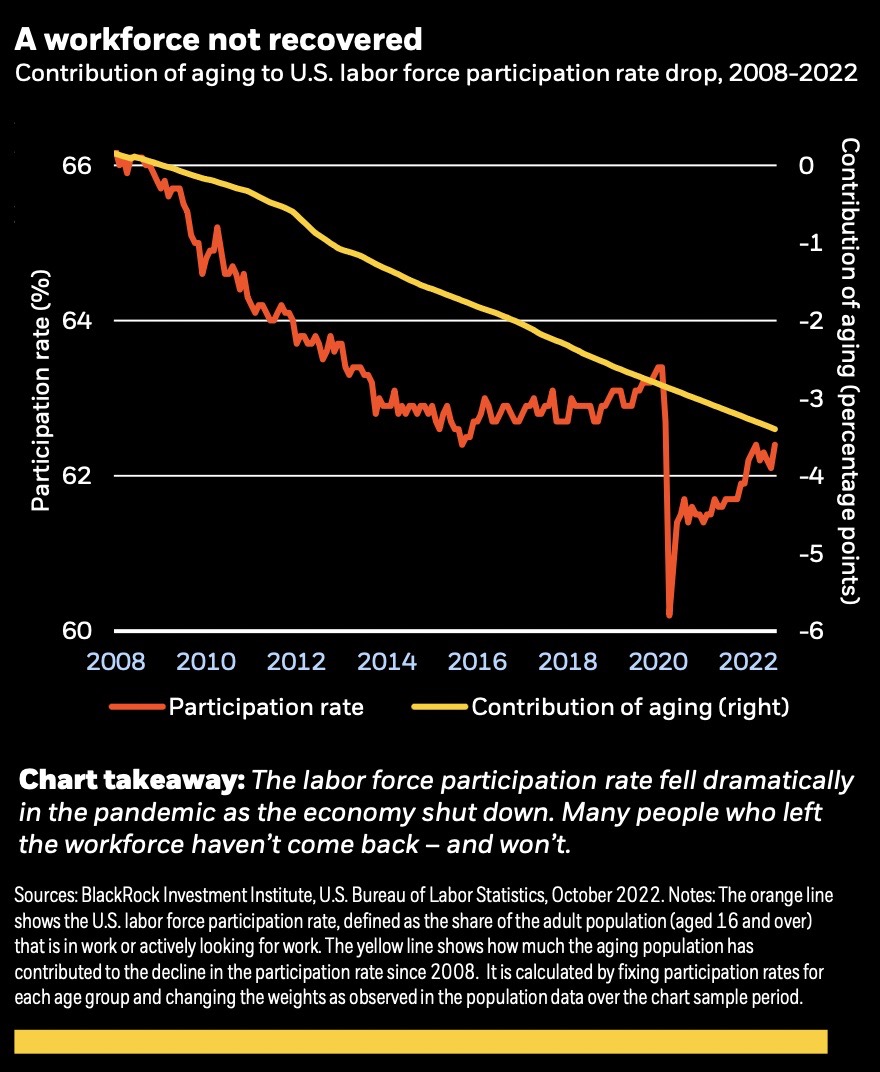

a) Aging workforces

- Aging workforces are negative for ecnomic growth.

- Production capacity will grow less quickly in the future as an ever-larger share of the population is past retirement age and not working.

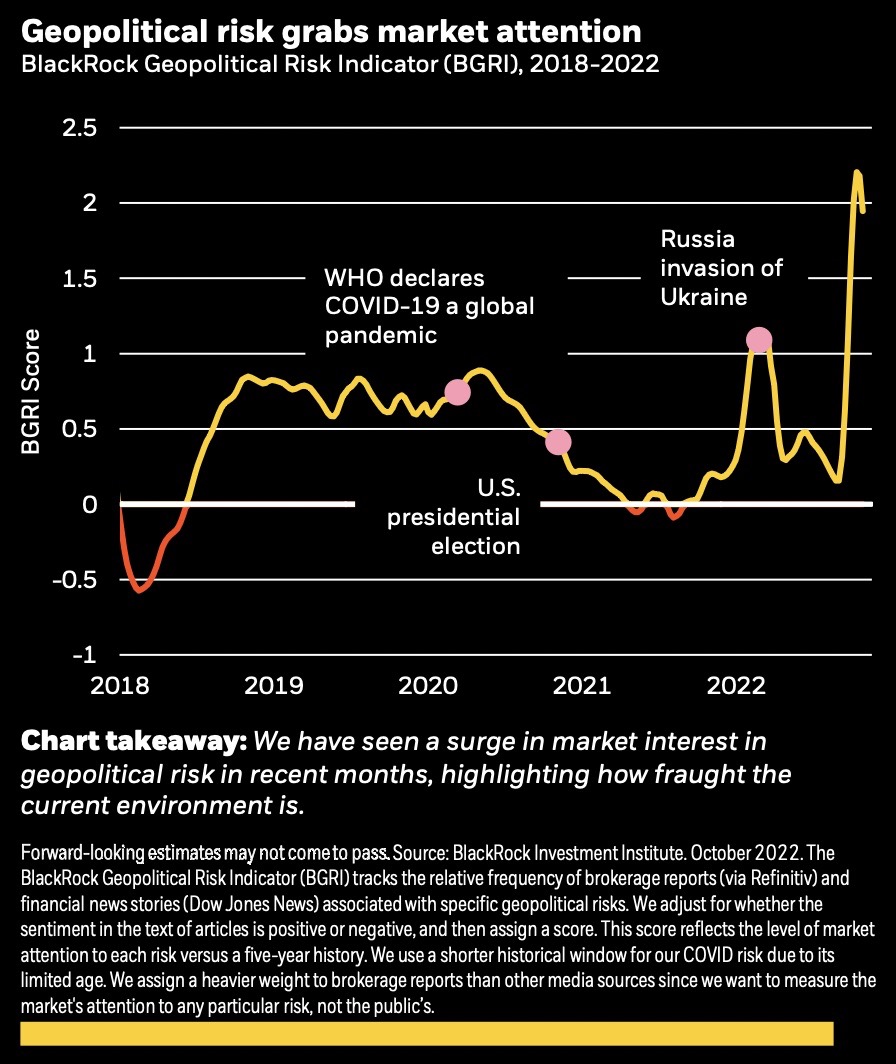

b) A new world order

- Most fraught geopolitical environment since WW2

- The world is splitting up into competing blocs that pursue self-reliance.

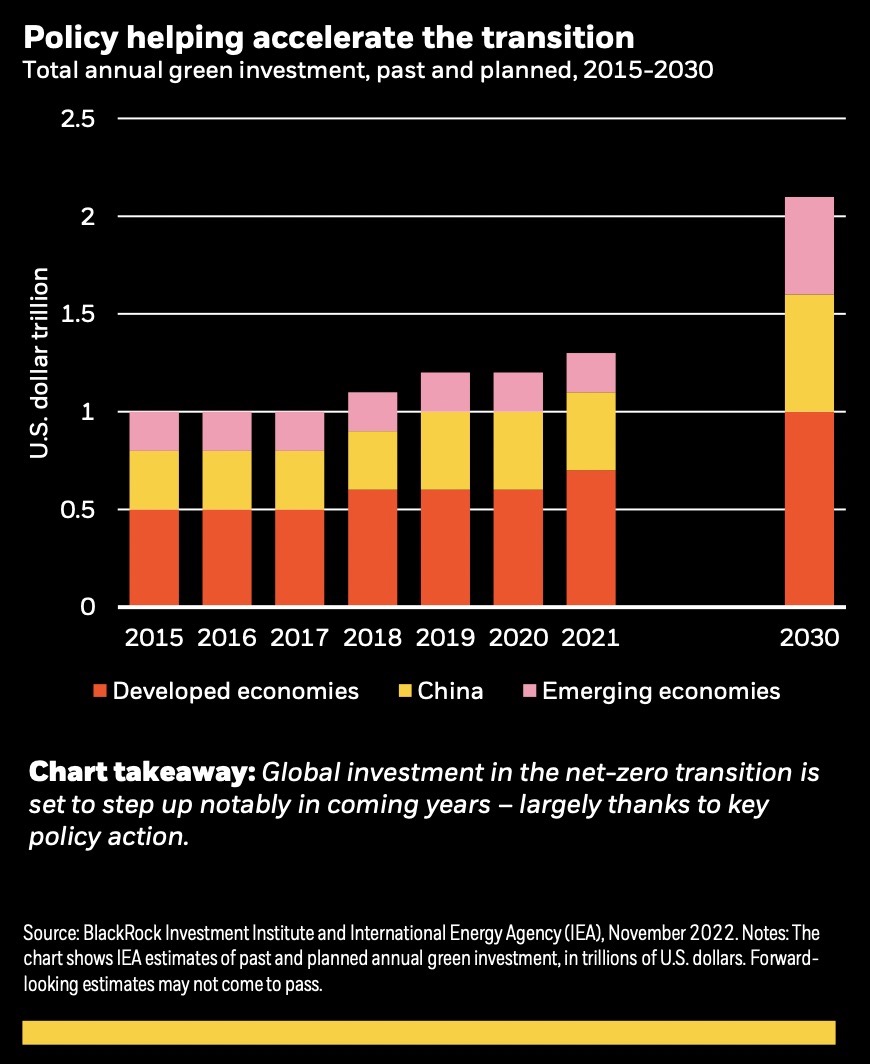

c) Faster transition

- Global investment in the net-zero transition is set to step up notably in coming years with key policy actions.

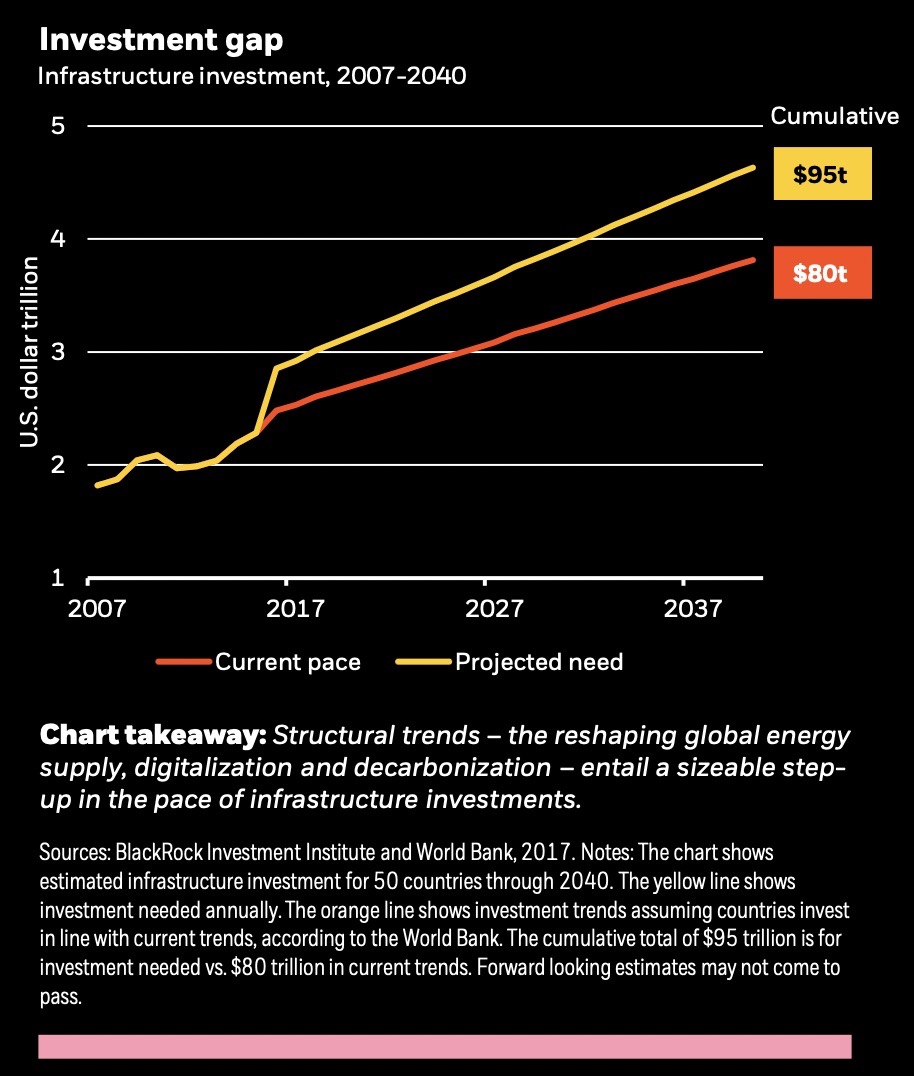

4. Private Markets - The long view on infrastructure

- infrastructure could provide a way to play into structural trends.

5. Directional view - Getting granular

※ 보고서 원본은 아래에서 확인 가능합니다.

2023 Global Investment Outlook | BlackRock Investment Institute

Paragraph-2 Paragraph-3,Paragraph-4,Advance Static Table-1,Paragraph-5,Advance Static Table-2,Paragraph-6,Advance Static Table-3 Paragraph-7,Image-1,Paragraph-8,Image-2,Paragraph-9,Image-3,Paragraph-10,Image-4

www.blackrock.com

'1. 투자에 관한 모든 것 > 매크로' 카테고리의 다른 글

| [매크로] 매크로의 함정 - 시장을 움직이는 진짜 에너지 (14) | 2023.02.10 |

|---|---|

| [매크로] 미국 달러 - DXY (1) | 2022.12.16 |

| [매크로] 미국채수익률 & 최종 기준금리 (0) | 2022.12.15 |

| [매크로] 영국 파운드화 (2) | 2022.09.29 |

| [매크로] 미국 달러 인덱스의 종류와 달러의 현재 위치 (0) | 2022.09.27 |

댓글