728x90

Developing Economies: A Proven Use Case for Crypto

Source: Conor Ryder, CFA, Kaiko Research

Bottom line:

One of crypto’s biggest use cases: Financial Freedom

Crypto offers a path away from wealth destruction, but close to Wealth Preservation.

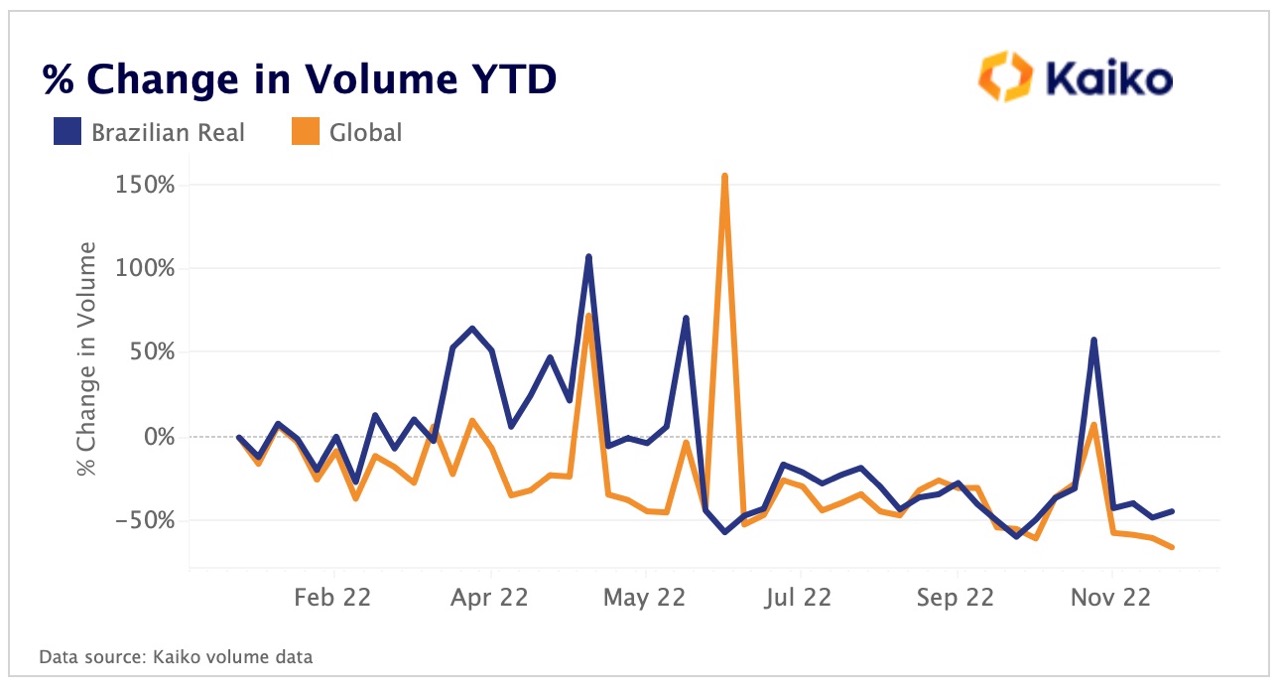

Use Case 1. Brazil

Wealth Protection

- Brazilian Real (BRL) devalued by over 200% during last 10 years = Damage to savings in domestic currency

- Capital controls by Brazilian government on foreign currencies.

- Brazilian bank accounts can only hold Brazilian Reals.

- Brazilians became desperate for an alternative to protect their savings. = Stablecoins

- Stablecoins eneable Brazilians to participate in global markets and tie their savings directly to the US Dollar.

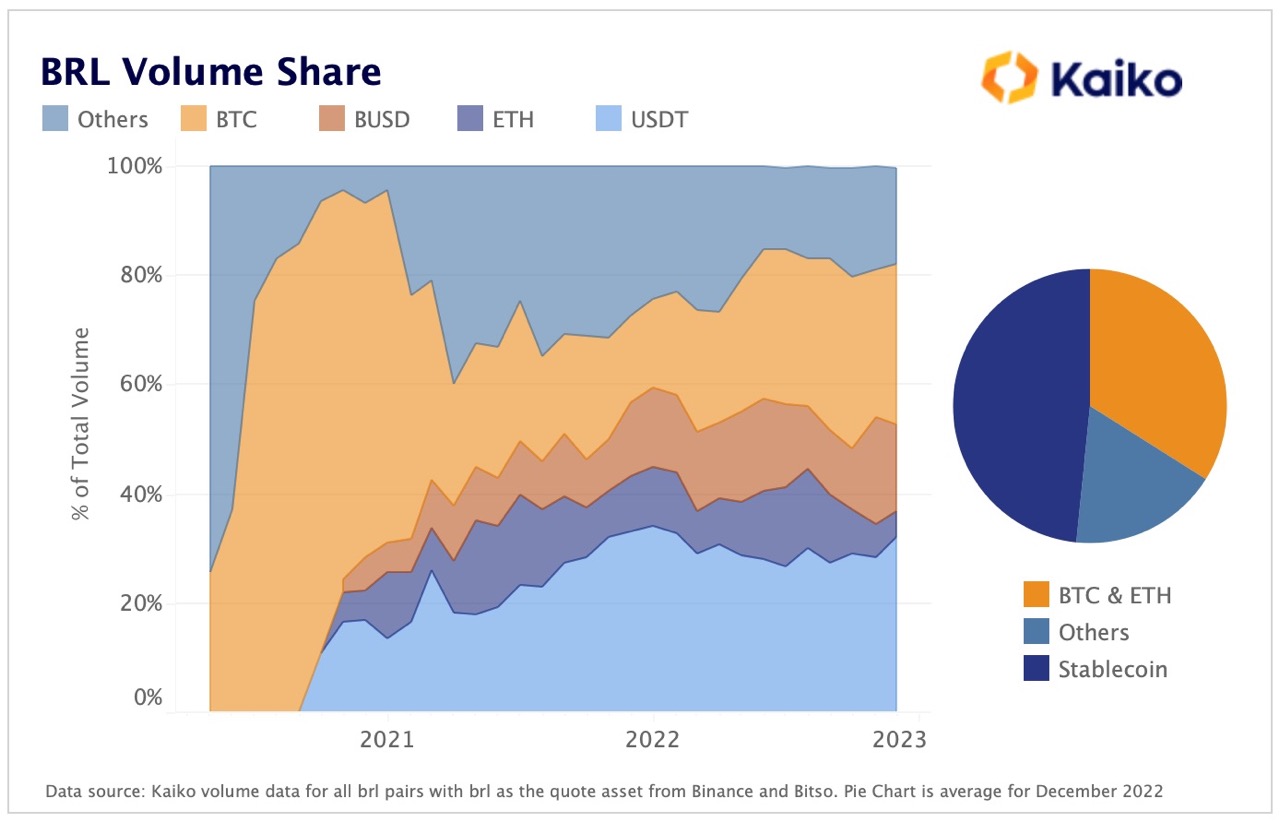

- Stablecoin trading volumes on BRL pairs: 50%

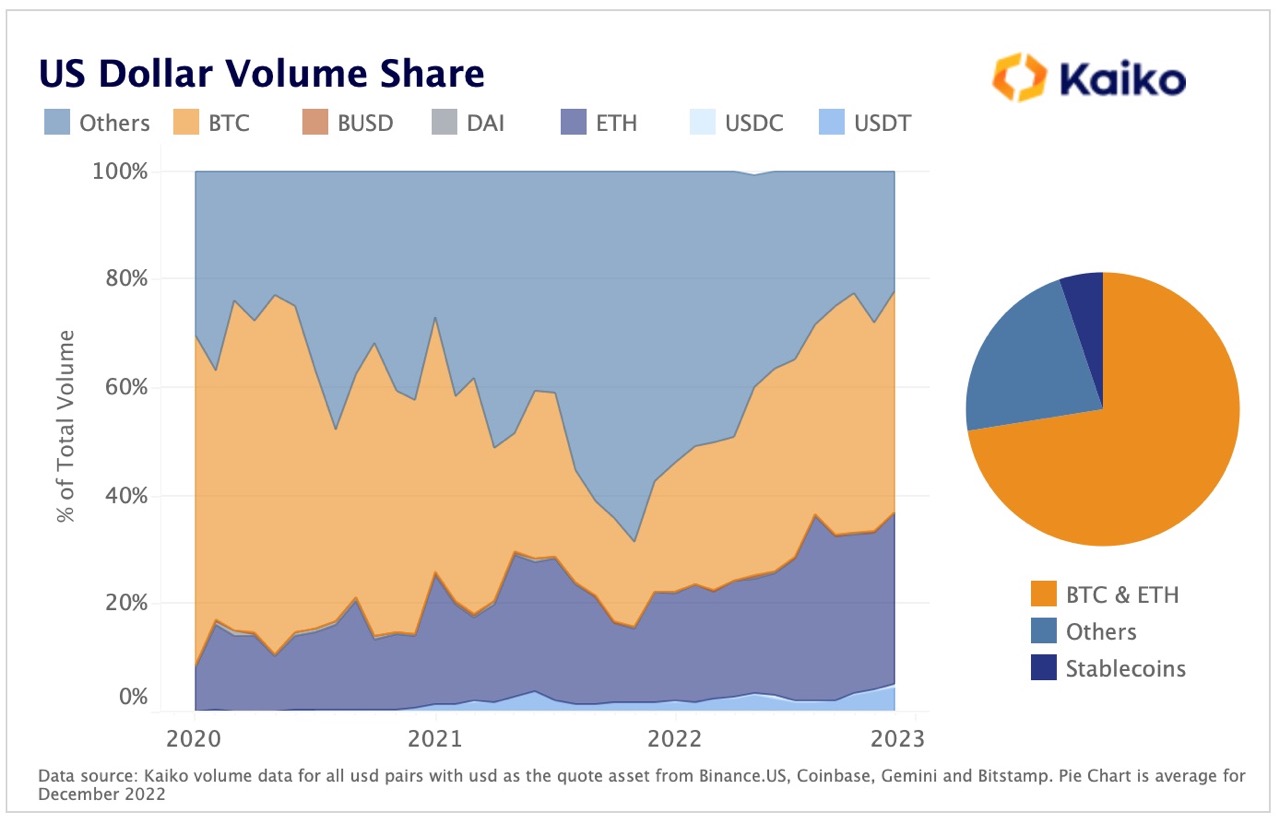

- Volumes on USD-denominated pairs: 5%

- USDT has increased its share of total BRL-denominated volume by nearly 20% at the expense of altcoins

- Brazilians = Prefer stablecoins(safety) over the altcoins(speculation).

- According to a report by Chainalysis, roughly 41% of Brazilian adults own some cryptocurrency.

- Brazil: 66% saying that cryptocurrency is the future of money.

- US: 23%

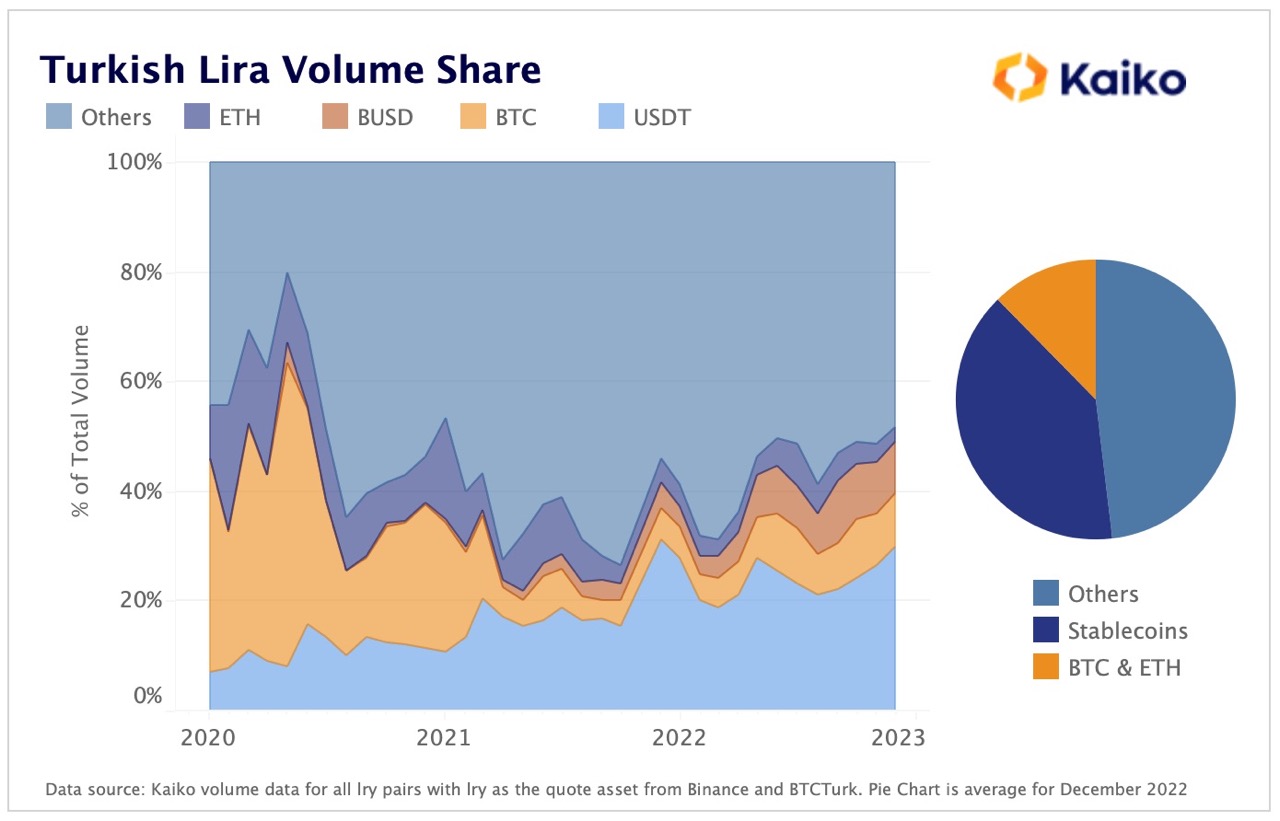

Use Case 2. Turkey

Wealth Protection

- Turkish Lira, significantly devalued in the last number of years due to a record high inflation.

- September inflation YoY: 80%

- Turkish people are moving to crypto to protect their wealth.

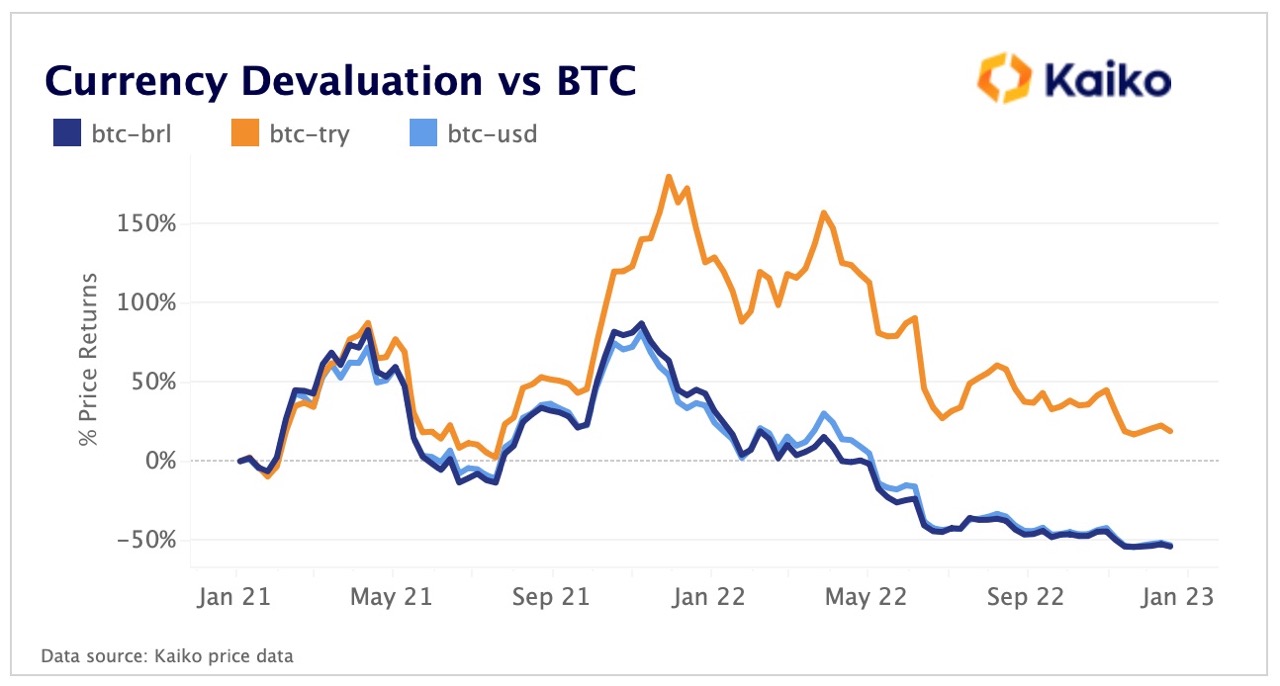

- Turkey: Faster currency devaluation

- BTC/TRY: Above 15% profit range when quoted in Lira

- BTC/USD: Below -50% loss range

- BTC/BRL: Below -50% loss range

- Stablecoin trading volume: 40% in Turkey’s most popular exchanges, Binance and BTCTurk.

Takeaways

- Rising USDT dominance since the Lira experienced major devaluation in 2021.

- Turkish's huge interest on altcoins as evidenced by the share of “Others” volume (48%).

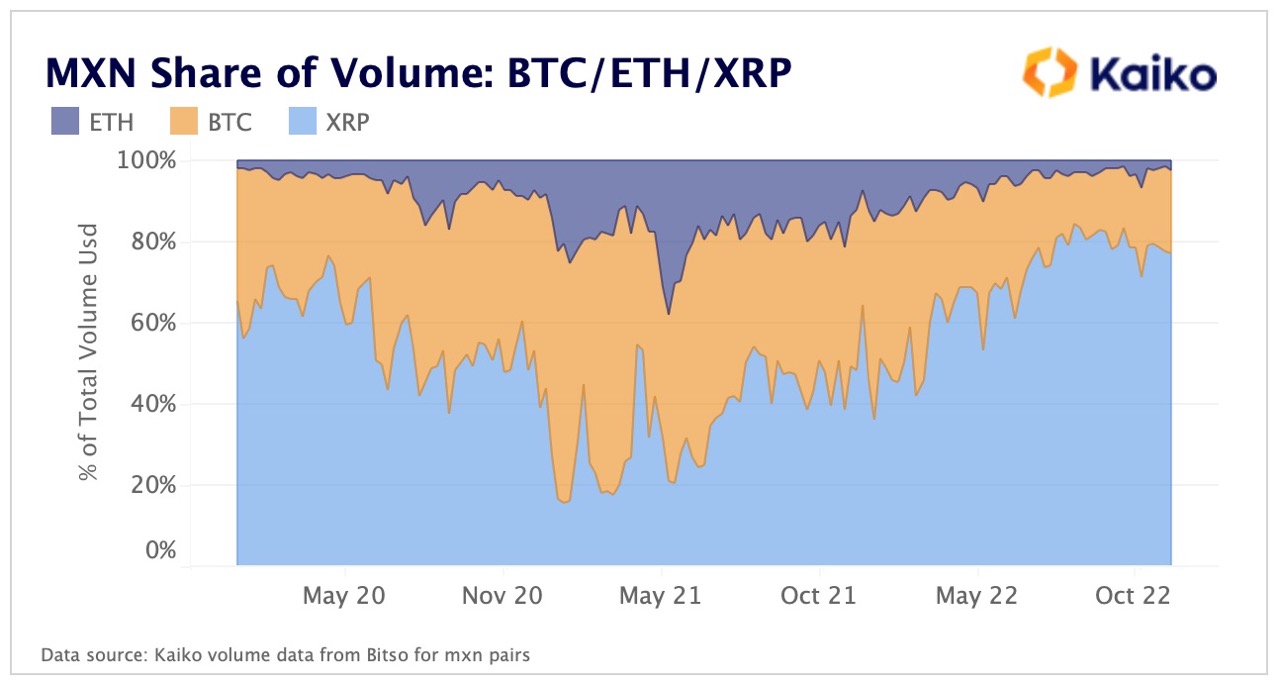

Use Case 3. Mexico

Remittance payments

- Mexico: Second largest recipient of remittances in the world, according to 2021 statistics

- Remittance fees as high as 12%

- Huge opportunity for crypto companies by offering lower fees to customers

Ripple (XRP)

- Since 2022, XRP's market share of trading vs BTC and ETH on Bitso grew from 36% to 77% of volume

You can read a full article below.

Developing Economies: A Proven Use Case for Crypto

marketing.kaiko.com

'2. 암호화폐에 관한 모든 것 > 시장분석' 카테고리의 다른 글

| [시장분석] 암호화폐 시장친화적으로 변화 중인 홍콩과 그것이 시장에 미칠 영향 (15) | 2023.02.24 |

|---|---|

| 10 Defining Market Events of 2022 by Kaiko Research (1) | 2022.12.27 |

| Discrepancies between Market cap & Liquidity rank (4) | 2022.12.09 |

댓글