인베스팅 데일리 리캡 INVESTING DAILY RECAP - 10/20/2022

FOR PERSONAL RECORDS

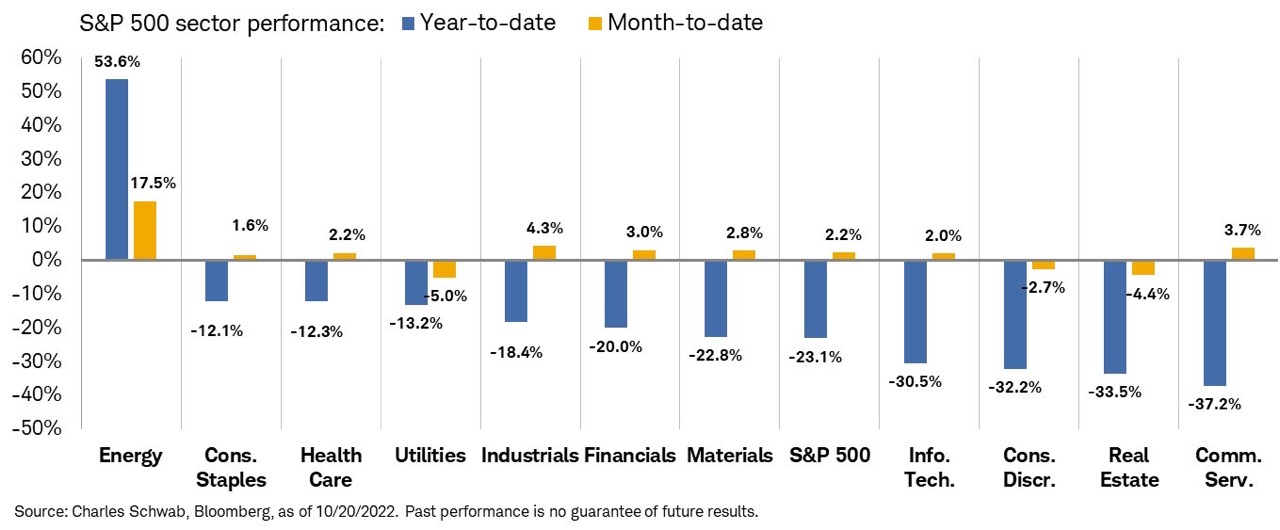

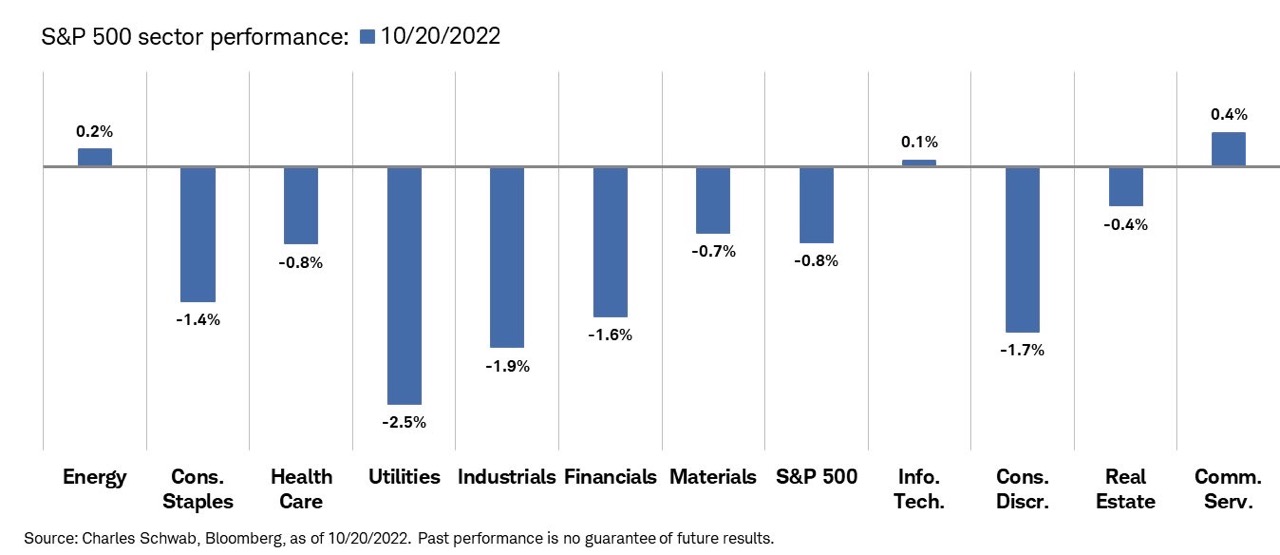

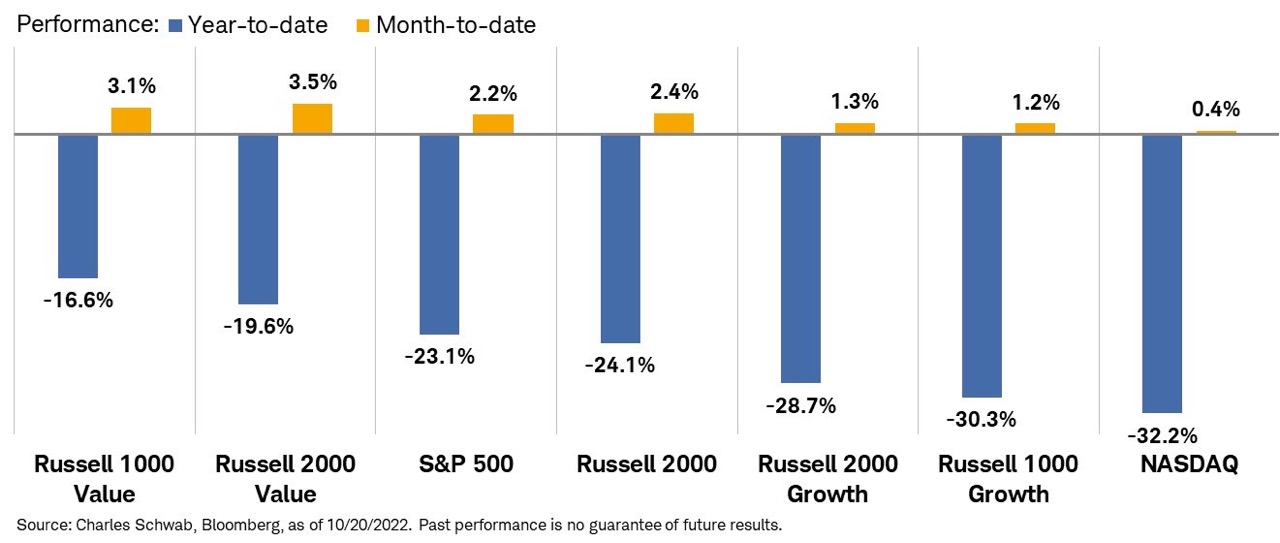

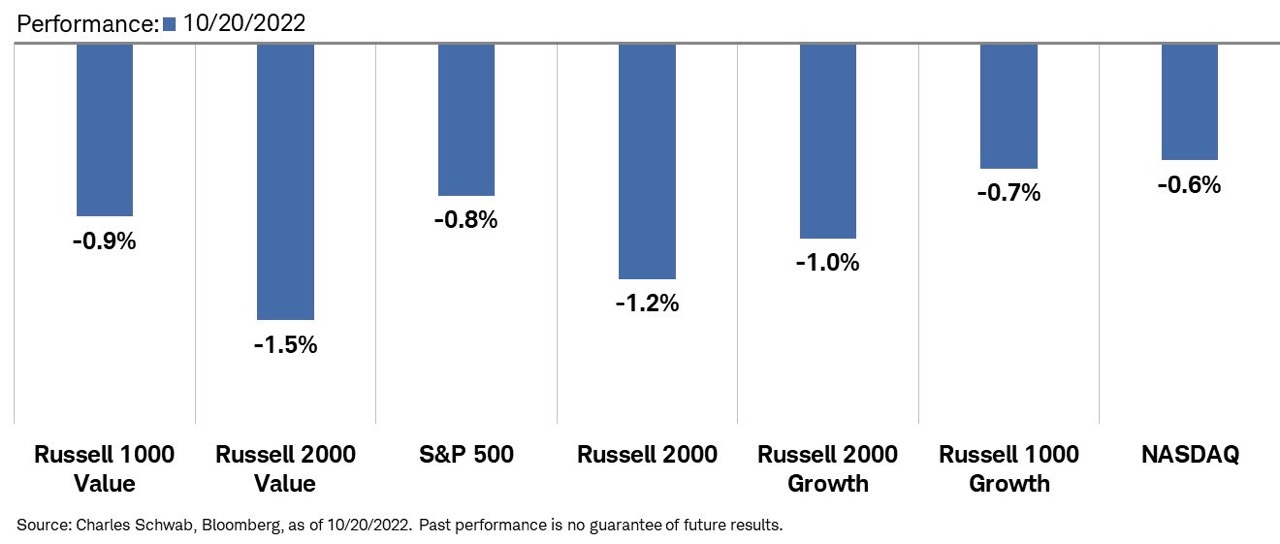

- S&P 500 -0.80% Dow Jones -0.30% Nasdaq -0.61% Euro Stoxx +0.62%

- DXY -0.05% EXY +0.15% JXY -0.18% GBP -0.02% WON -0.06% 1429.04 CNY -0.21% 7.2129

- US02Y +1.12% 4.612 US10Y +2.27% 4.232 US30Y +2.28% 4.220

- WTI Crude -0.98% Natural Gas -1.71% Gold -0.10% BTCUSD -0.46%

- 3대 지수 하락 마감. 미 국채금리 계속 상승중. 주간 실업보험 청구자 수 감소로 긴축 우려 심화

[투자 메모] Data & Gloomy Economy Outlook

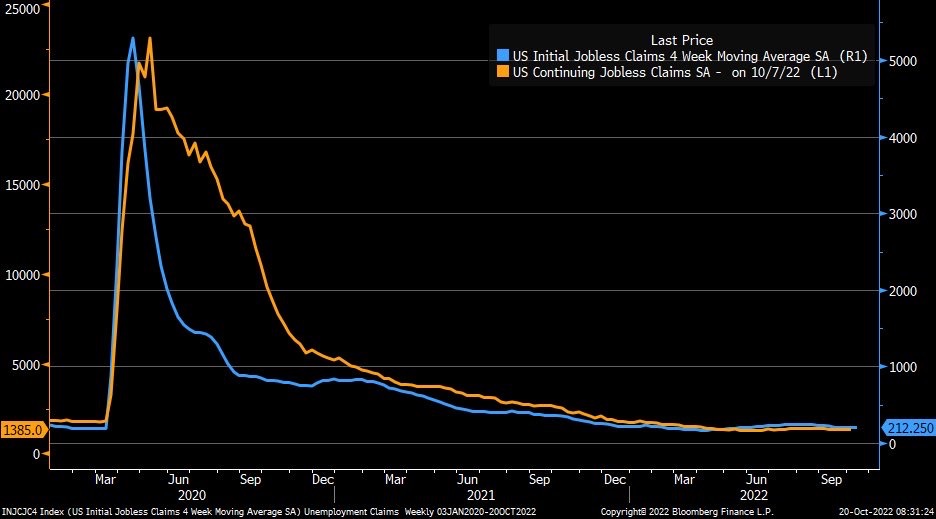

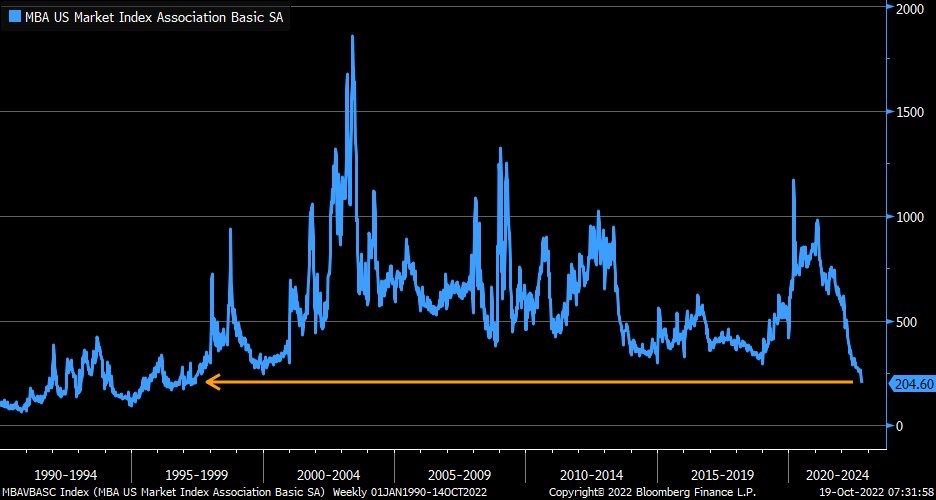

1) US Initial Jobless Claims

- 214k vs. 233k est. & 226k in prior week; continuing claims at 1.385M vs. 1.378M est. & 1.364M in prior week

2) Profitable Tech Index from Goldman Sachs

- up 14% vs. 86% for S&P 500

3) S&P 500 Financials sector FWD.EPS

- Getting slow, close to peak

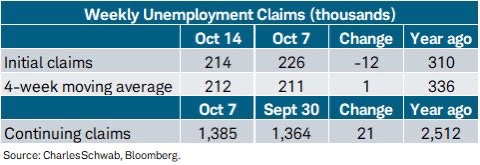

4) US Zillow Rent Index

- Rose by just 0.5% in September, smallest gain since February 2021

- Positive for lower CPI

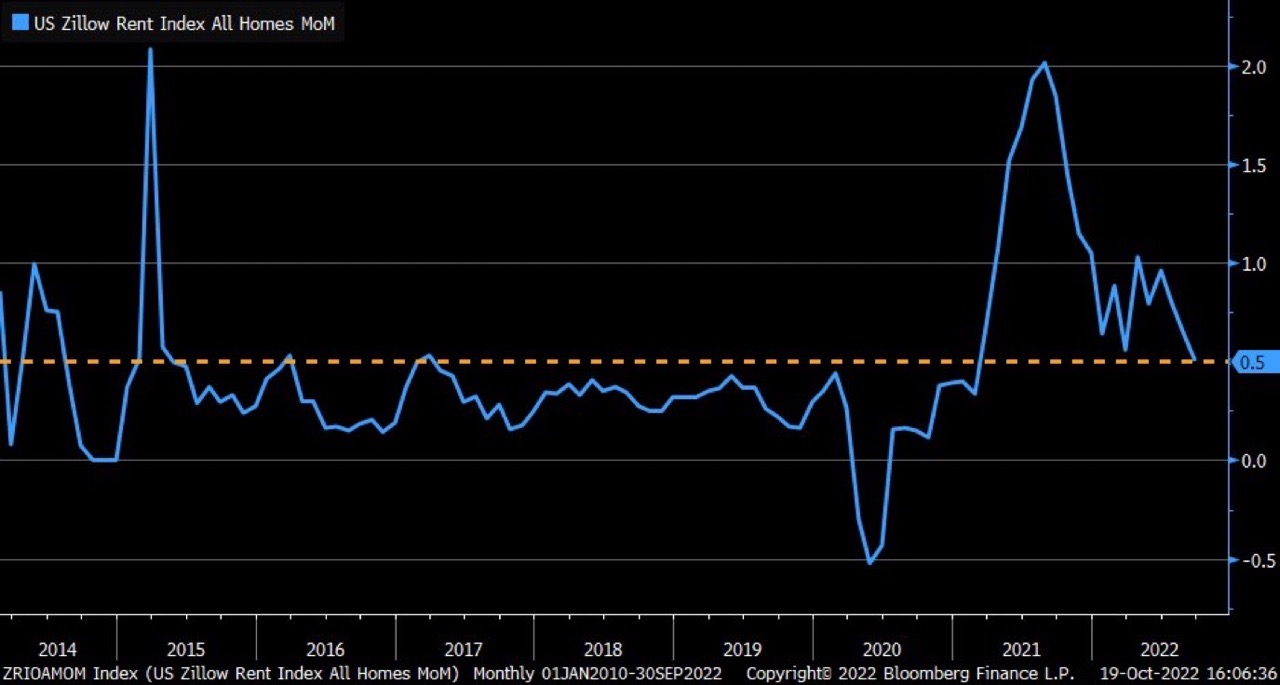

5) Mortgage Applications Index

- Lowest level since 1997

6) 09/2022 Existing Home Sales

- -1.5% vs. -2.1% est. & -0.8% M-1

- 8 consecutive months of declining sales (longest stretch since 2007)

- Median selling price +8.4% y/y to $384,800

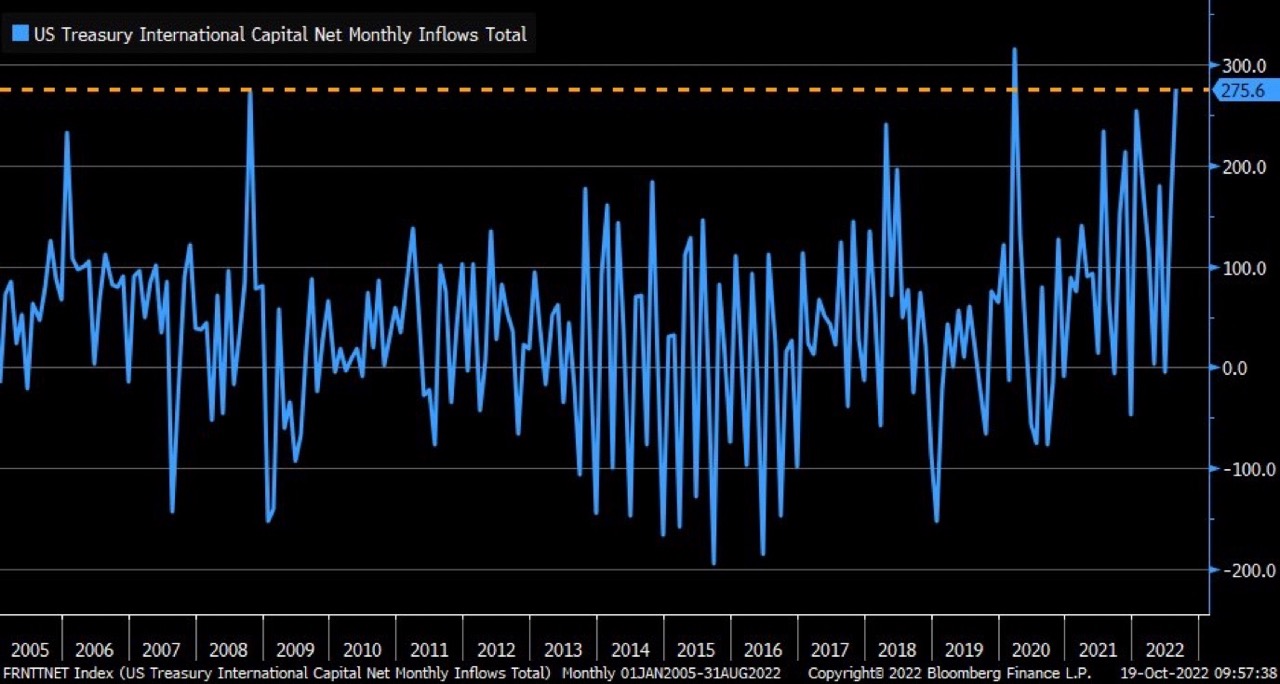

7) US Treasury International Capital Net Monthly Inflow

- Biggest spike since March 2020

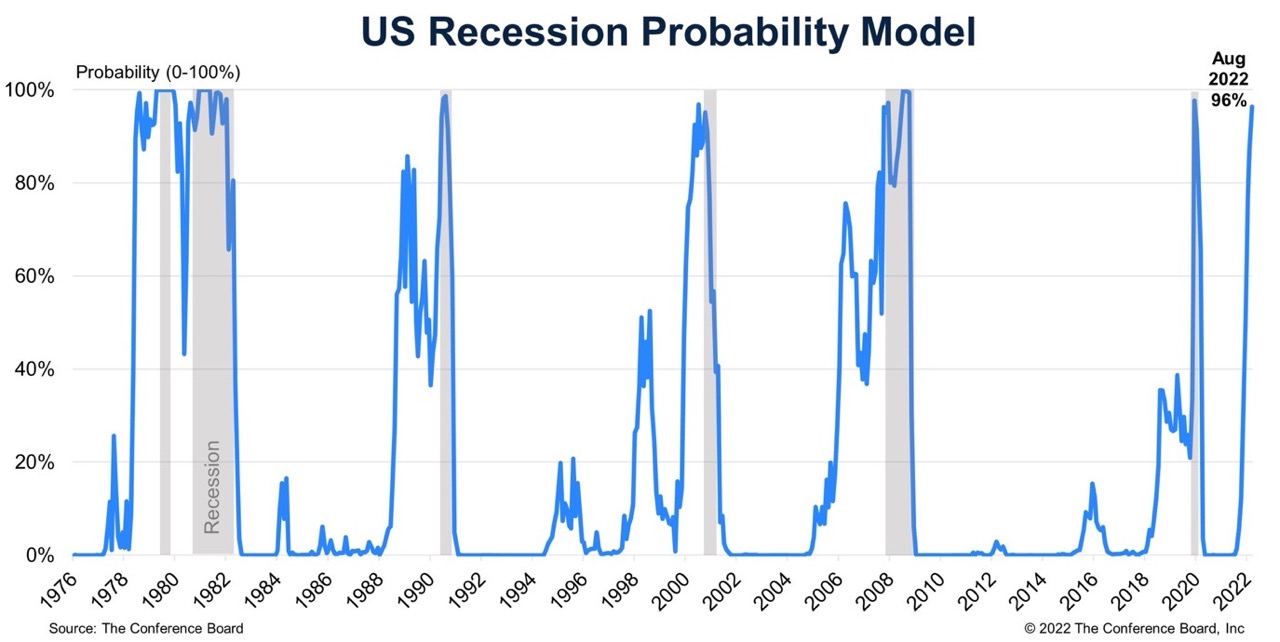

8) U.S. Recession Probability Model

- Probability U.S. enters recession within next 12 months

- 96% as of August, 2022

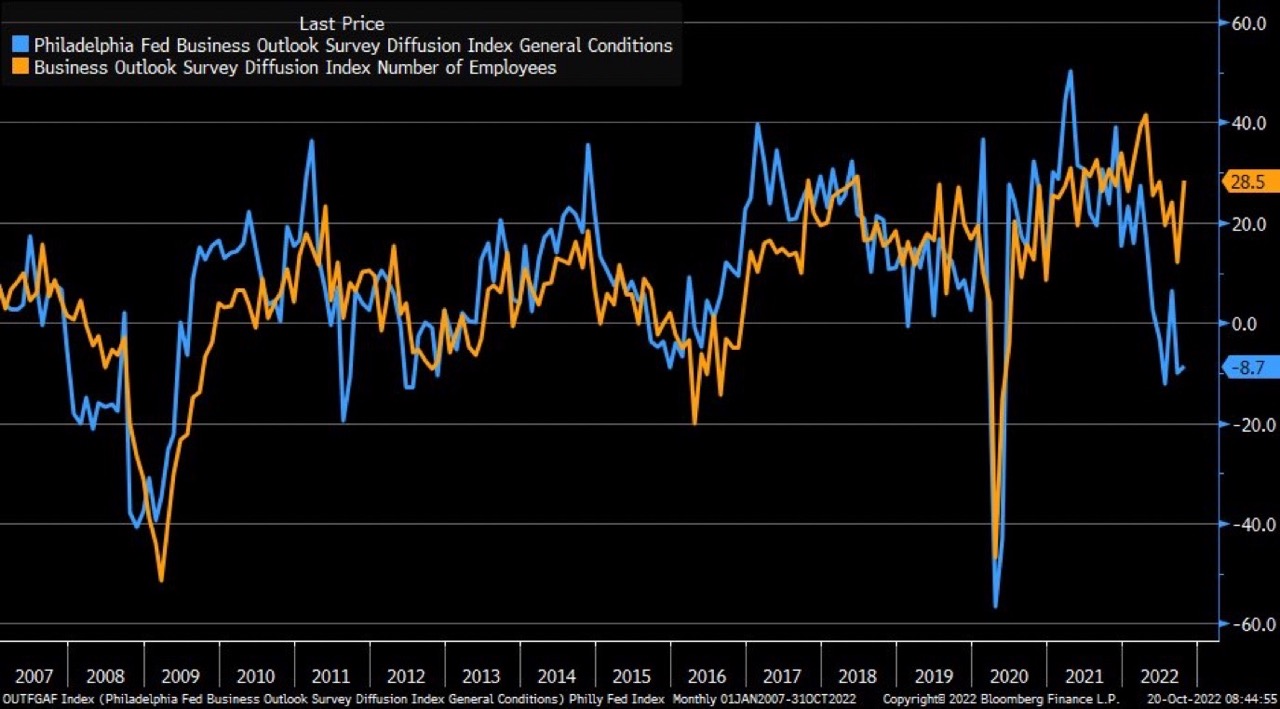

9) Philadelphia Fed Index

- -8.7 vs. -5 est. & -9.9 in prior month

- new orders jumped, employment rose to 28.5

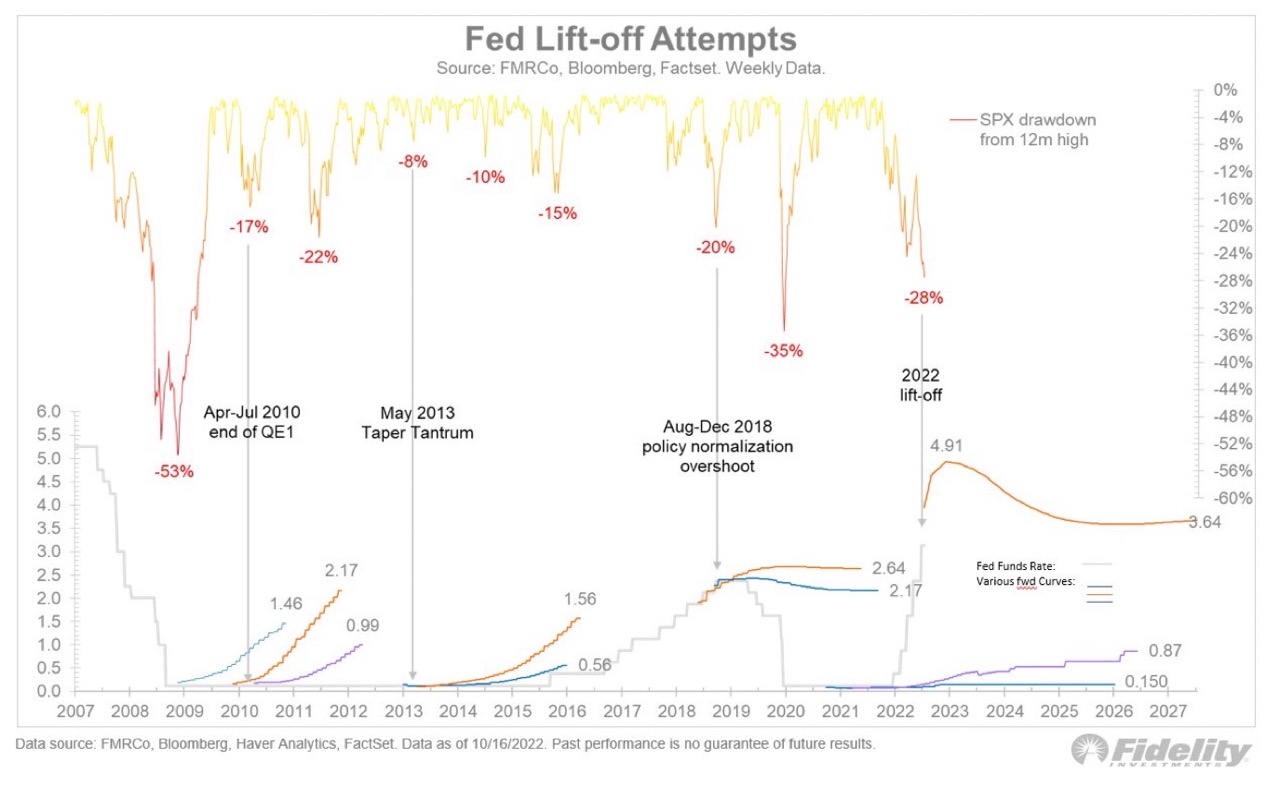

10) Fed Lift-off Attempts

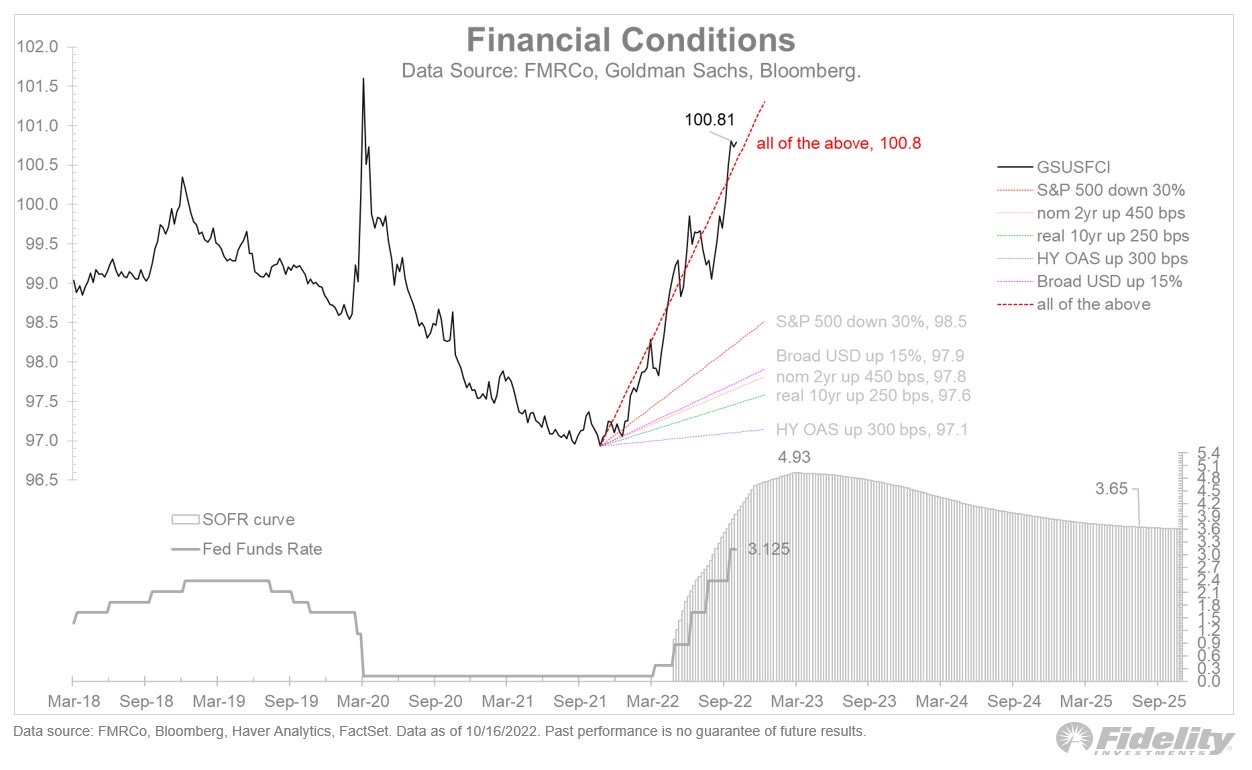

11) Financial Conditions

- Tightening fast

- SPX declines 30% over a year

- the dollar rises 15%

- high yield spreads widen 300 bps

- 2-year nominal yield increases 450 bps

- 10-year real yield increases 250 bps.

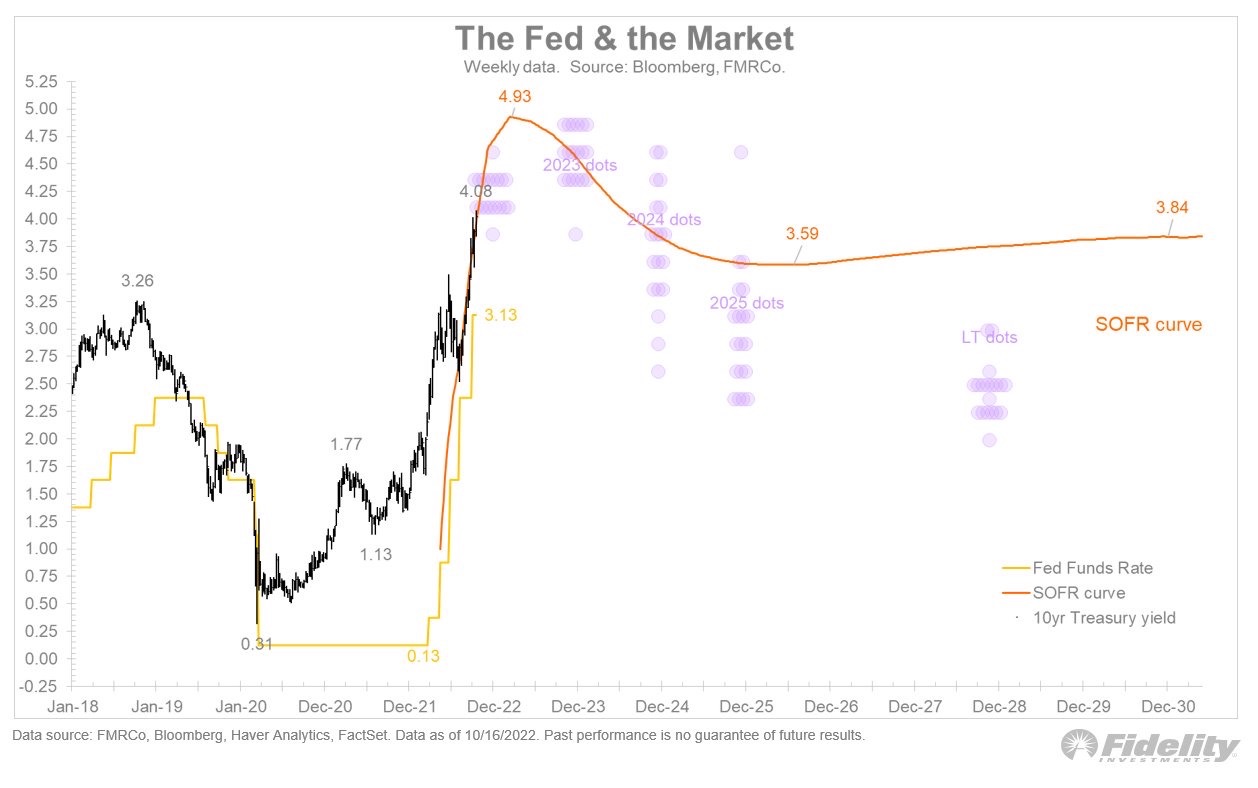

12) The Fed & the Market

- Expected Terminal rate of 4.93% by early 2023

- 130 bps of easing over the subsequent two years

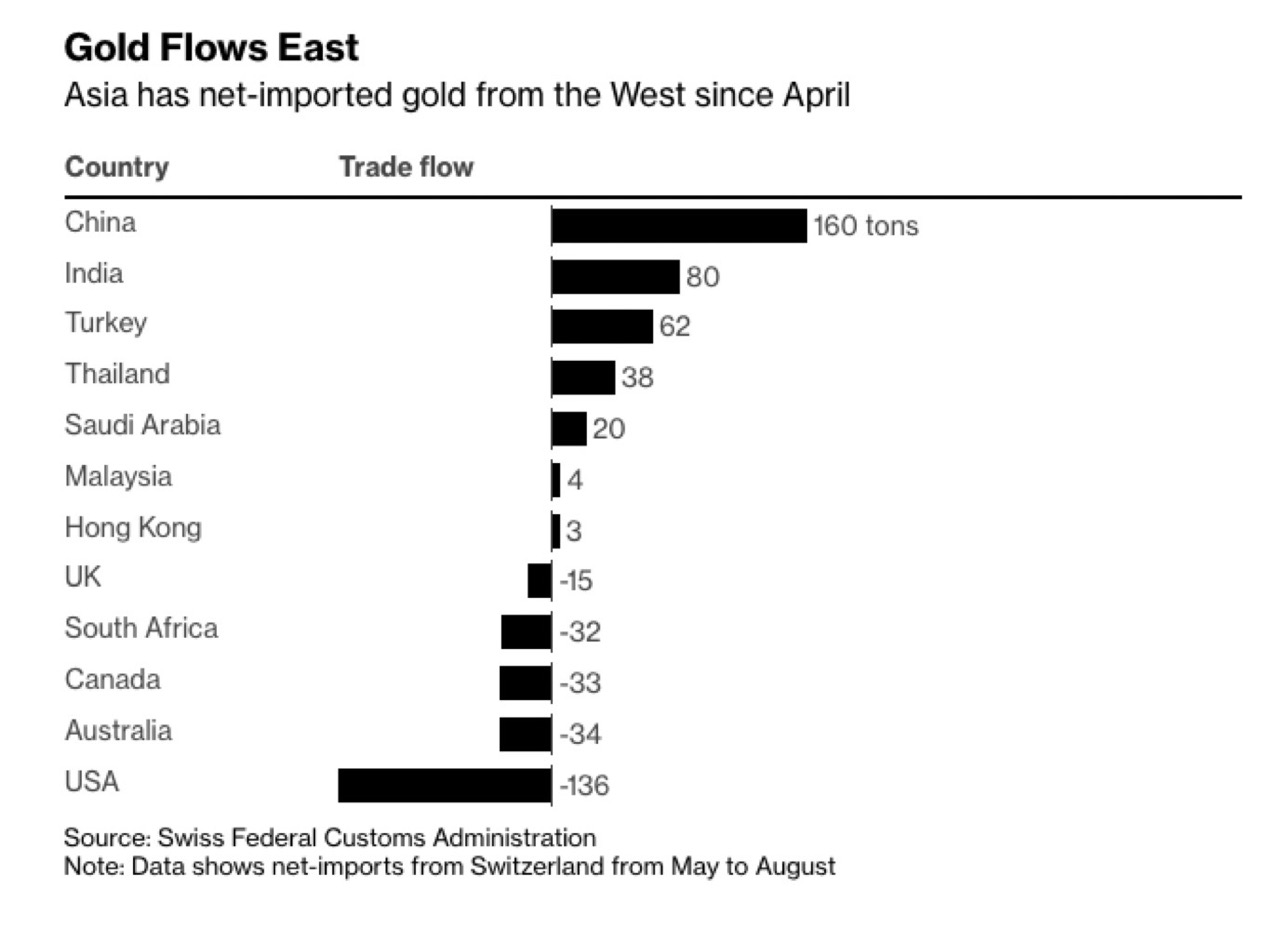

13) Gold

- West → East

'1. 투자에 관한 모든 것 > 주간증시요약' 카테고리의 다른 글

| JRFO Investing Weekly Market Recap (0) | 2022.11.07 |

|---|---|

| JRFO Investing Weekly Market Recap (0) | 2022.10.22 |

| JRFO Investing Daily Recap (1) | 2022.10.20 |

| JRFO Investing Daily Recap (2) | 2022.10.19 |

| JRFO Investing Daily Recap (0) | 2022.10.19 |

댓글