주간증시요약 - JRFO Investing Weekly Market Recap

- 한 주간 투자시장에서 나타난 금리, 환율, 원자재, 암호화폐, 미국과 대한민국 증시의 움직임과 투자자로서 캐치해야 될 핵심 포인트들에 대해서 알아보고, 앞으로 가져가야 할 투자 전략에 대해서도 공유해 보도록 하겠습니다.

Not a financial advice / Record, reference use only

목차

- 금리 YIELDS

- 환율 FOREX

- 원자재 COMMODITIES

- 암호화폐 CRYPTO MARKET

- 미국 증시 U.S. STOCK MARKET

- 주간증시요약 SUMMARY

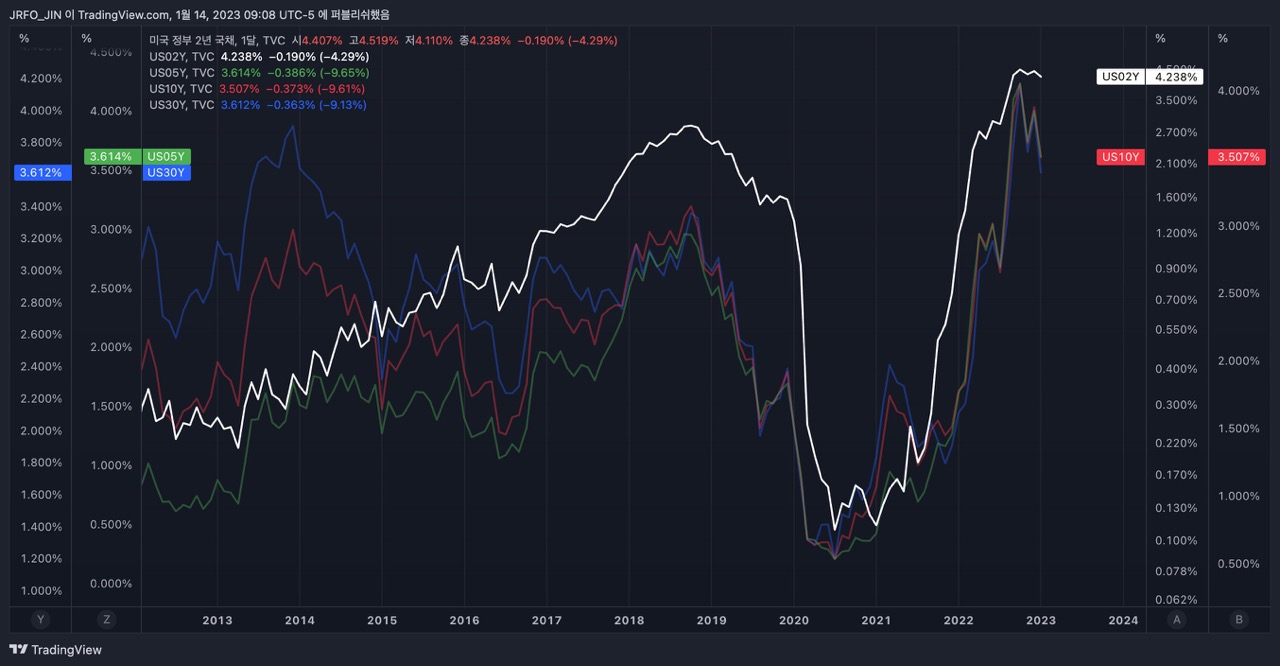

1. 미국채만기별 수익률 U.S. Yields

| RATE | 1W | |

| United States 2Y | 4.238% | -0.42% |

| United States 5Y | 3.614% | -2.35% |

| United States 10Y | 3.507% | -1.49% |

| United States 30Y | 3.612% | -2.06% |

TLT - Technical Analysis

TLT - iShares 20+ Year Treasury Bond ETF Technical Analysis 기술적 분석 Everything tends to unfold as it should. 흔들리는 것은 우리의 마음 뿐. It's all about Cycle.

tortortor.tistory.com

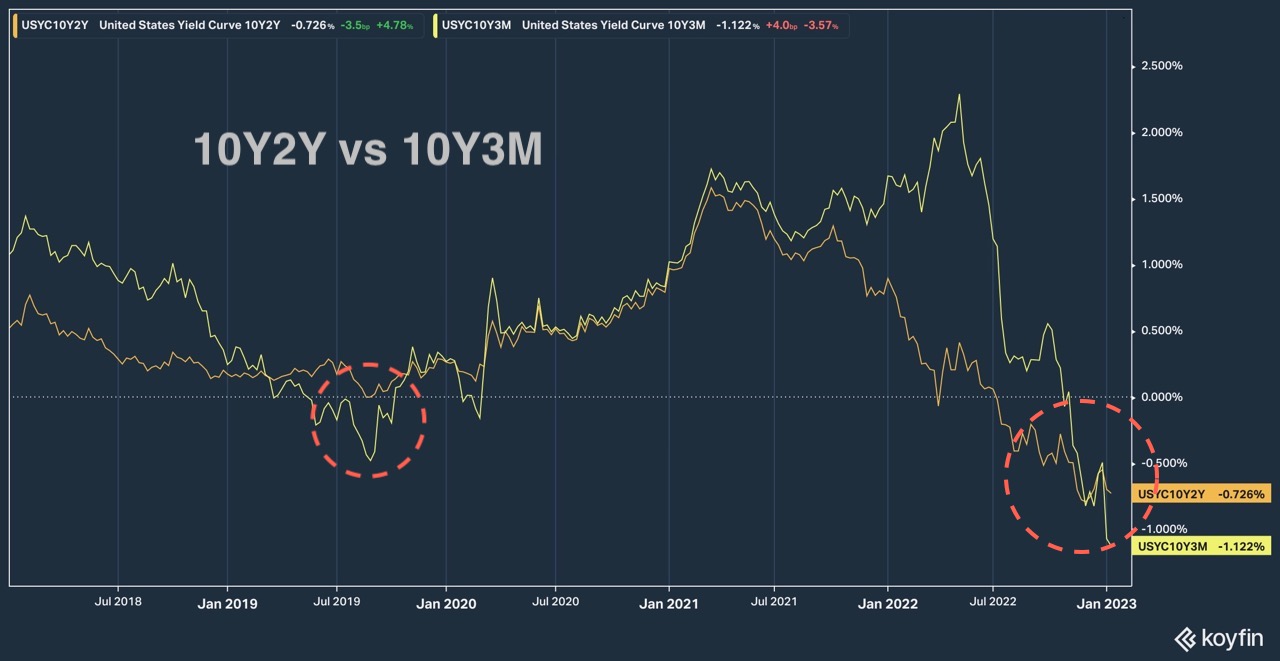

1-1 장단기금리차 Yield Conversion

| CONVERSION | |

| United States 10Y vs 3M | -1.122% |

| United States 10Y vs 2Y | -0.726% |

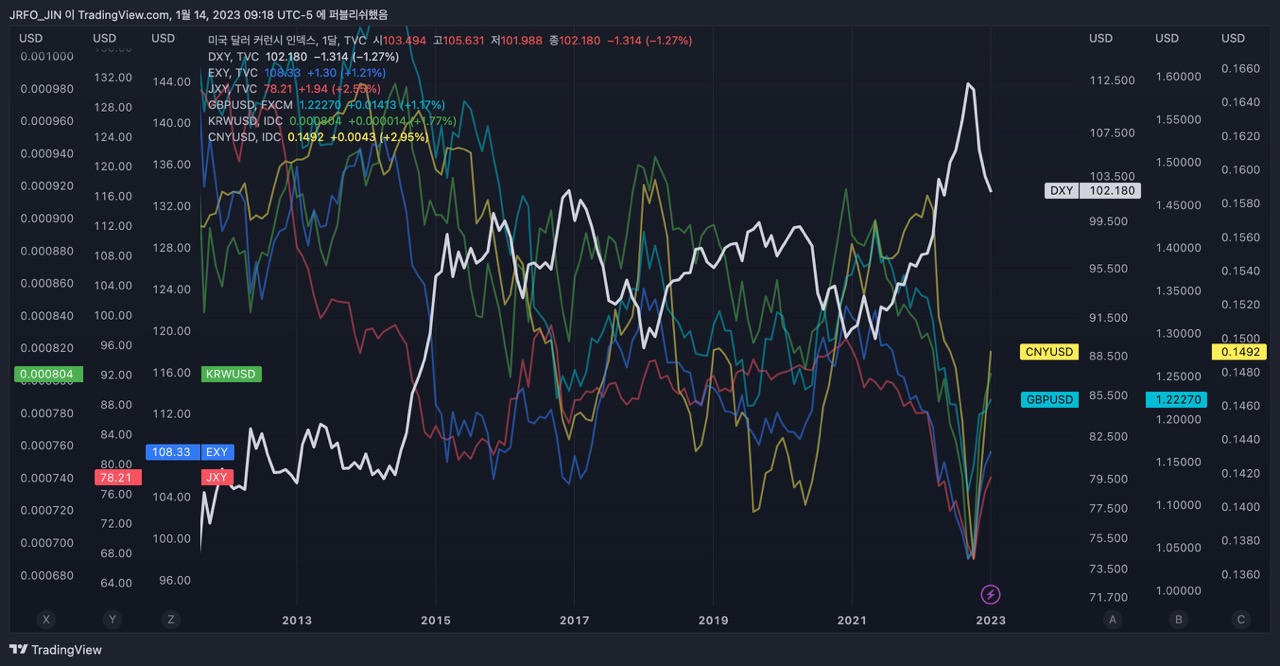

2. 환율 Forex

| TICKER | WEEKLY | TREND | |

| 달러 Dollar | DXY | ↘ | Bearish ↘ |

| 유로 Euro | EXY | ↗ | Bullish ↗ |

| 엔 Yen | JXY | ↗ | Bullish ↗ |

| 위안 Yuan | CNYUSD | ↗ | Bullish ↗ |

| 원 Won | KRWUSD | ↗ | Bullish ↗ |

Macro - US Dollar, DXY

Macro - US Dollar, DXY Bottom line: Retracement is natural in cycle. Macro - Inflation losing steam Macro - Inflation losing steam FFR vs US02Y vs US10Y 기준금리 vs 2년물, 10년물 Bottom line: December will be the last rate hike of this cycle. 12월

tortortor.tistory.com

10year Cycle - Developed vs Emerging

10-year Cycle - Developed vs Emerging Historically proven strategy Bottom line: 1982 ~ 1991 Emerging 1992 ~ 2001 Developed 2002 ~ 2011 Emerging 2012 ~ 2021 Developed 2022 ~ 2031 Emerging Smart Money Switching Strategy

tortortor.tistory.com

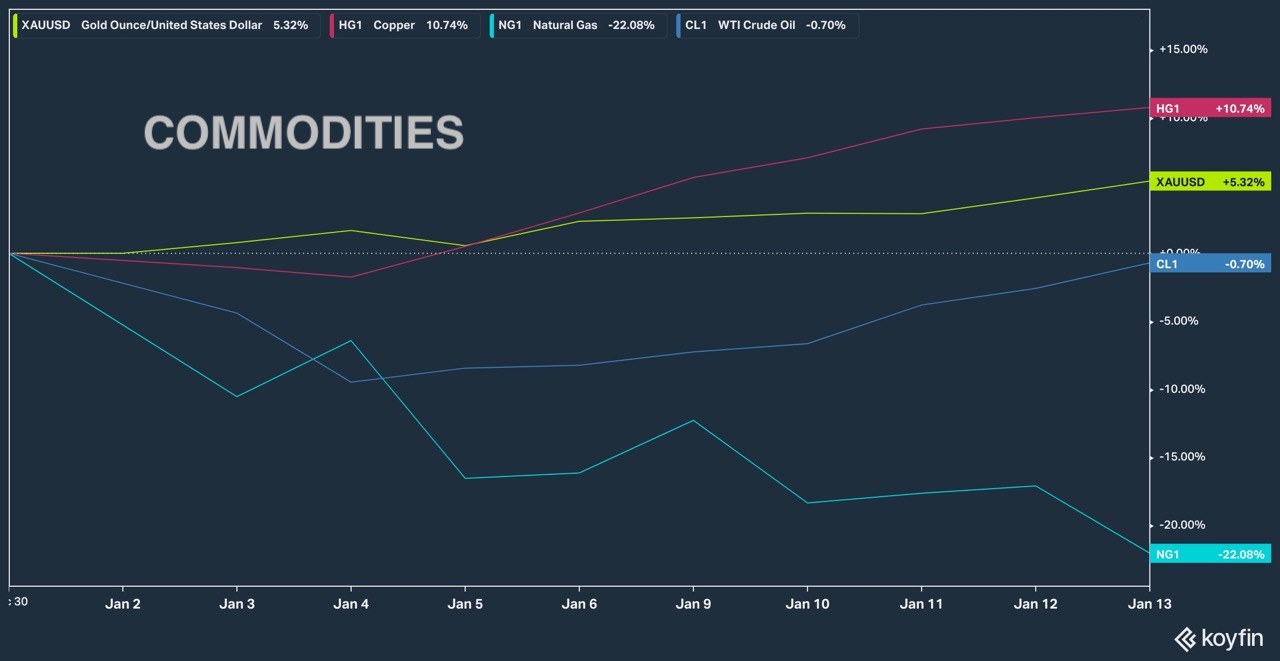

3. 원자재 Commodities

| STRATEGY | 1W | YTD | |

| 원유 WTI | LONG | +8.64% | -0.70% |

| 천연가스 Natural Gas | SHORT | -8.80% | -22.08% |

| 금 Gold | LONG | +2.93% | +5.32% |

| 구리 Copper | LONG | +7.55% | +10.74% |

Macro - Gold

Macro - Gold 금에 대한 시각차 금 GOLD 금은 인플레이션으로 물가가 상승하는 동안 떨어지는 현금(=달러)의 가치를 보관하는 유용한 수단이자 투자의 관점에서 포트폴리오에 일정 부분을 편입해서

tortortor.tistory.com

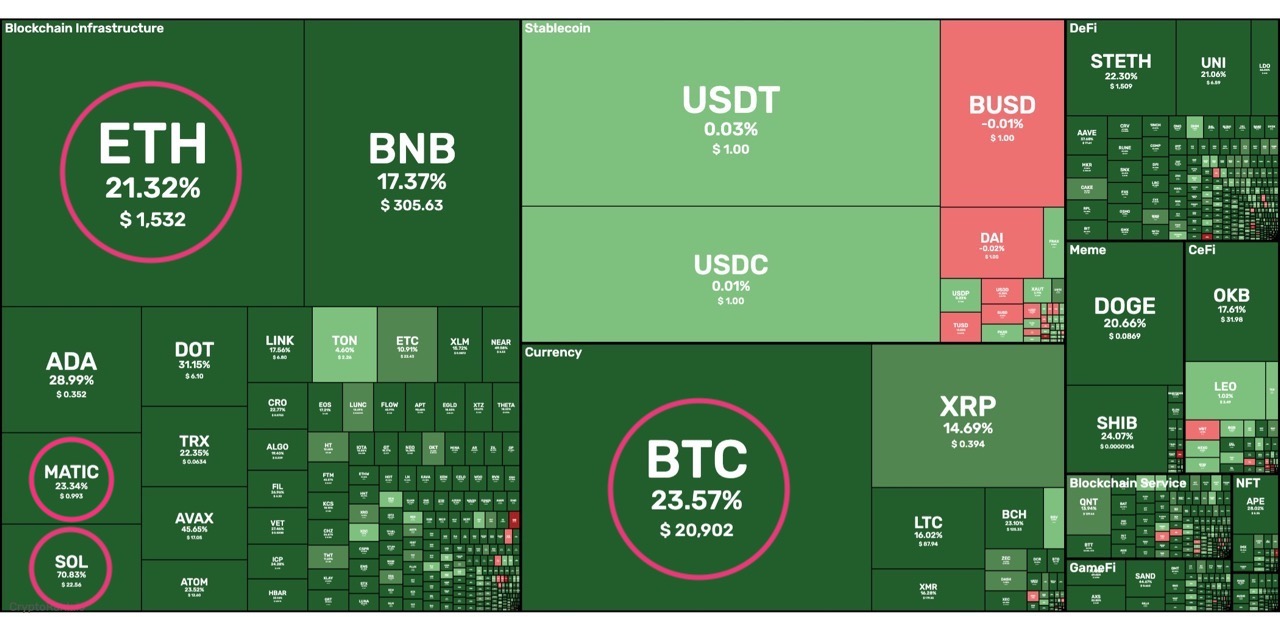

4. 가상자산 암호화폐 시장 Cryptocurrency Market

| HOLDINGS | |

| 비트코인 BTC | +23.57% |

| 이더 ETH | +21.32% |

| 솔라나 SOL | +70.83% |

| 폴리곤 MATIC | +23.34% |

BTC Technical Analysis

Very Close to the Bottom Trend is a friend until the end.

tortortor.tistory.com

5. 미국 증시 U.S. Stock Market

| WEEKLY | |

| S&P 500 | +2.67% |

| Dow Jones Industrial | +2.00% |

| Nasdaq | +4.82% |

| HOLDINGS | |

| 테슬라 TSLA | +8.26% |

| 아마존 AMZN | +13.99% |

| 메타 META | +5.35% |

| 버라이즌 VZ | -0.78% |

7. S&P 500 vs Nasdaq

S&P 500 vs Nasdaq PRINCIPLES Trend & Cycle Bottom Line: Valuation: S&P 500(SPX) < Nasdaq(IXIC) Risk vs Reward: S&P 500 has more downside risk while Nasdaq is close to bottom 1. Nasdaq 2. S&P 500

tortortor.tistory.com

8. DOW, NASDAQ, S&P 500 - Cycle +Elliott wave analylsis

8. DOW, NASDAQ, S&P 500: Cycle +Elliott wave analylsis Dow since 1897 Nasdaq since 1974 S&P 500 since 1872 Bottom line: Dow / Nasdaq > S&P 500 ONE LAST RALLY REMAINING 1. Dow Jones Industrial Average Index 2. Nasdaq Composite Index 3. S&P 500

tortortor.tistory.com

7. 주간증시요약 Investing Weekly Summary

| CHECKLIST | STRATEGY | ||

| Risk | U.S. Stock Market | ↗ | BUY |

| Yield |

US 2Y | ↘ | BUY CREDIT BOND |

| US 10Y | ↘ | ||

| Yield Conversion | 10Y3M: ↗ 10Y2Y: ↗ |

||

| Forex |

USD | ↘ | |

| Euro | ↗ | ||

| Yen | ↗ | BUY EMERGING |

|

| Yuan | ↗ | ||

| Won | ↗ | ||

| Comm. | WTI Crude Oil | ↗ | BUY |

| Natural Gas | ↘ | ||

| Gold | ↗ | BUY | |

| Copper | ↗ | BUY | |

| Crypto | Bitcoin | ↗ | BUY ACCUMULATION PERIOD |

'1. 투자에 관한 모든 것 > 주간증시요약' 카테고리의 다른 글

| 주간증시요약-JRFO Investing Weekly Market Recap (19) | 2023.01.28 |

|---|---|

| 주간증시요약 - JRFO Investing Weekly Market Recap (22) | 2023.01.22 |

| 주간증시요약 - JRFO Investing Weekly Market Recap (0) | 2023.01.07 |

| 주간증시요약 - JRFO Investing Weekly Market Recap (7) | 2023.01.02 |

| JRFO Investing Weekly Market Recap (0) | 2022.12.26 |

댓글